1/24/2022

Jan 24, 2022

Markets started the overnight stronger but traded largely weaker heading into the coffee break after trade verified some beneficial rains in South America. The USDA made an 8 am announcement this morning, confirming two export sales; 150,000 tonnes of corn to unkonwn for 2021/22 and 132,000 tonnes of soybeans to China split evenly between the 2021/22 and 2022/23 marketing years. Corn and soybeans continued their lower trend into the day session, trading daily lows around midday, and were able to bounce back. Corn closed making fresh highs on the day and soybeans were able to lift themselves 20 cents off of their lows and maintain a close above the 1400 level. The action in grains was similar to what was seen across other market places with the DOW trading 1400 points lower and crude oil down over $4 at one point throughout today. We saw characteristics of a panic sell-off across the spectrum today but was met with enough buying to recover a significant portion of losses. Weekly export inspections were within target but on the low end of estimates for corn and soybeans with 1.116 mln tonnes of corn and 1.298 mln tonnes of soybeans inspected last week. Current shipment pace has corn 148 million bushels short of meeting the USDA yearly target, shrinking from 155 million bushels the previous week. Soybean shipments exceed the pace needed to meet the USDA forecast by 6 million bushels, down from 16 million the previous week. This has been the trend over the past 4-5 weeks and is likely to continue as logistics turn more focus towards shipping corn.

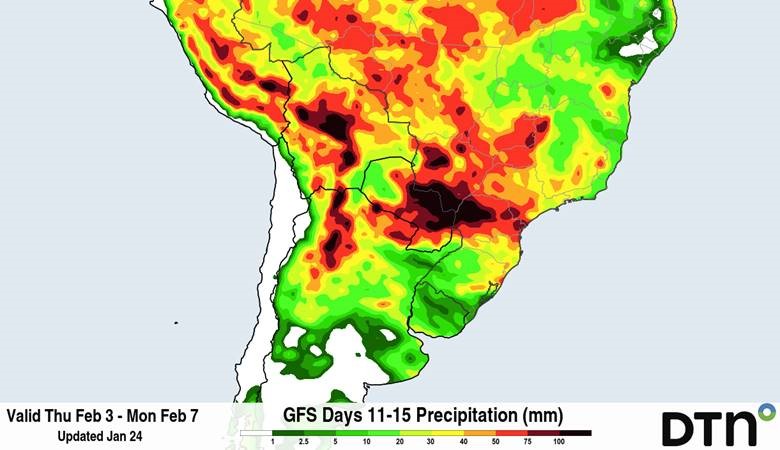

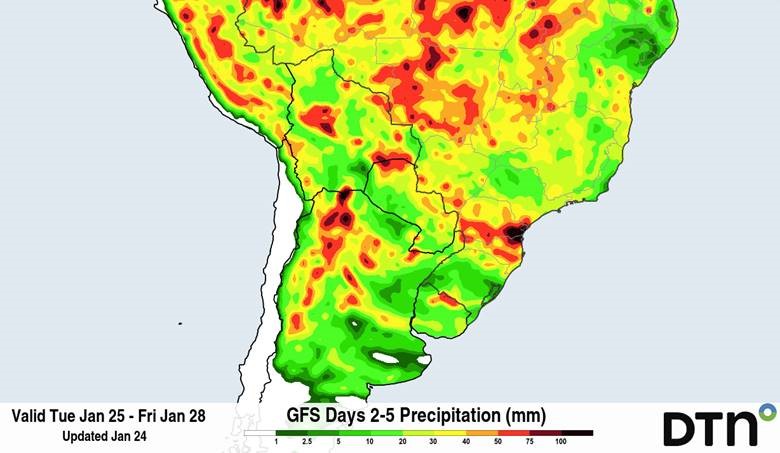

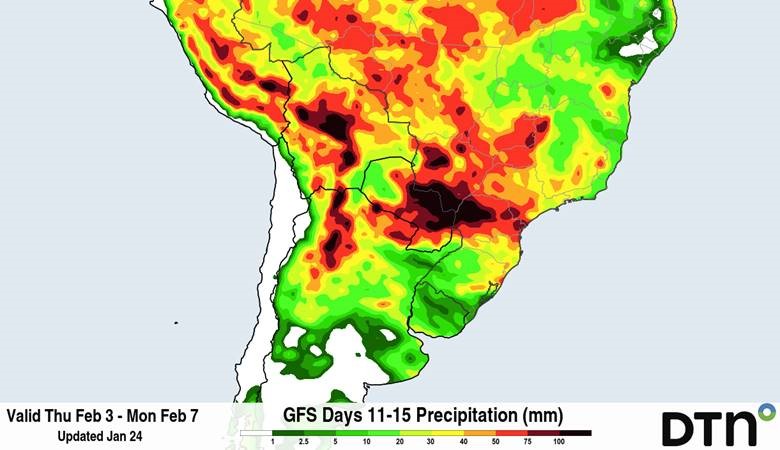

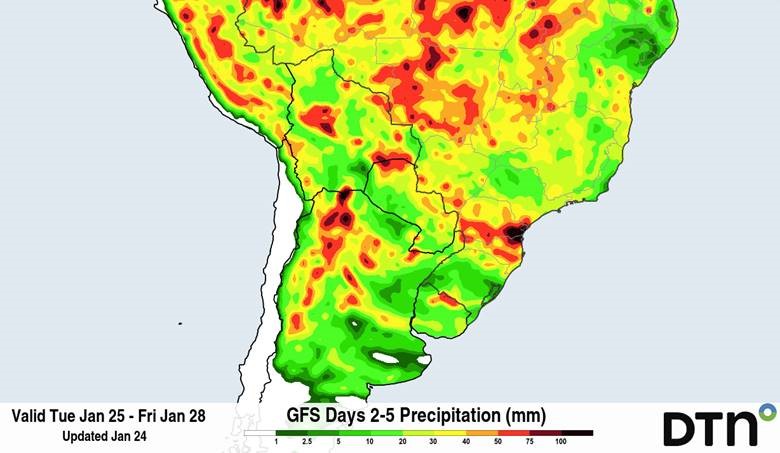

Weather forecast in Brazil continues to improve as we march steadily into their wet season.

Weather forecast in Brazil continues to improve as we march steadily into their wet season.