12/27/2021

Dec 27, 2021

The rally in soybeans continues with front months finishing the day 30 cents in the black. Soybean meal was also strong today, with gains of $6-8 ton. Right or wrong, the money is here to buy on what they think is going to be a short crop in South America. Today was our 9th consecutive higher close for soybeans, adding $1.18 to the January contract within that timeframe. South American weather remains unchanged and at this point there is enough momentum and money behind this market that trade will want to see an actual rainfall verified rather than just see one in the forecast. Corn was higher on spillover strength from soybeans. The USDA announced an export sale at 8 am this morning of 269,240 tonnes of corn to unknown for the 2021/2022 marketing year. Weekly export inspections were strong for soybeans with 1.57 million tonnes inspected for shipment, in the upper half of trade's estimated range. Corn inspections were below target at 719k tonnes vs the 875k tonne low estimate. Wheat inspections were within trading range but on the low end at 271k tonnes inspected. Corn shipments are behind the pace needed to meet the USDA's target by 175 million bushels, improving from last week's figure of 186 million bushels. Soybean shipments exceed the pace needed to hit the USDA target by 21 million bushels, improving from last week's figure of 9 million bushels.

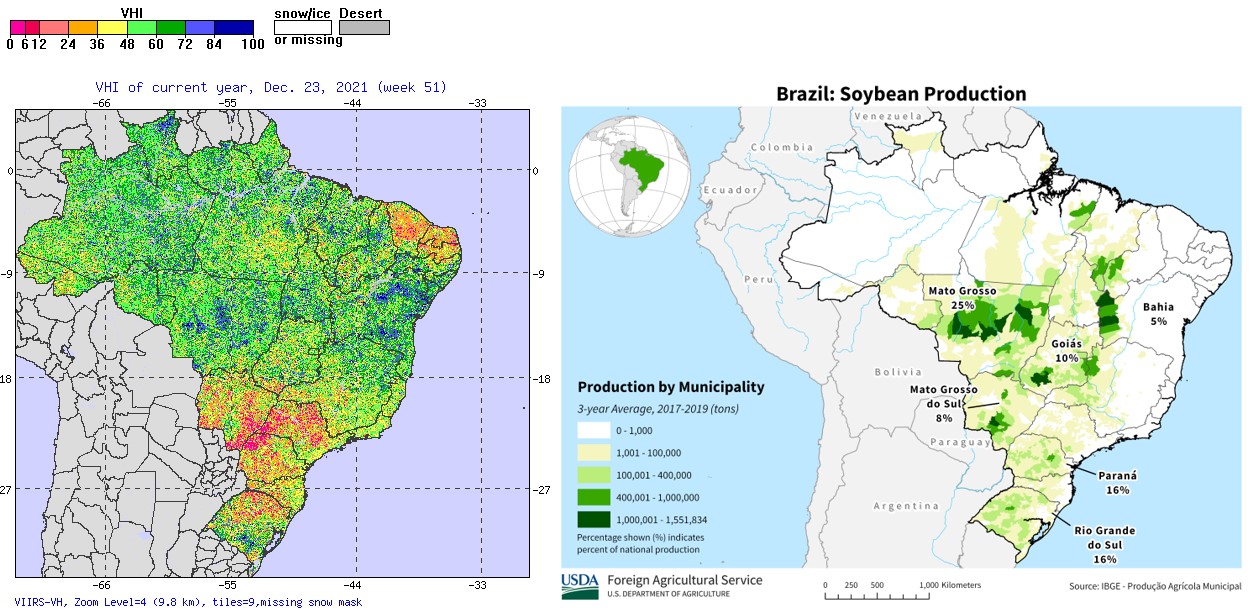

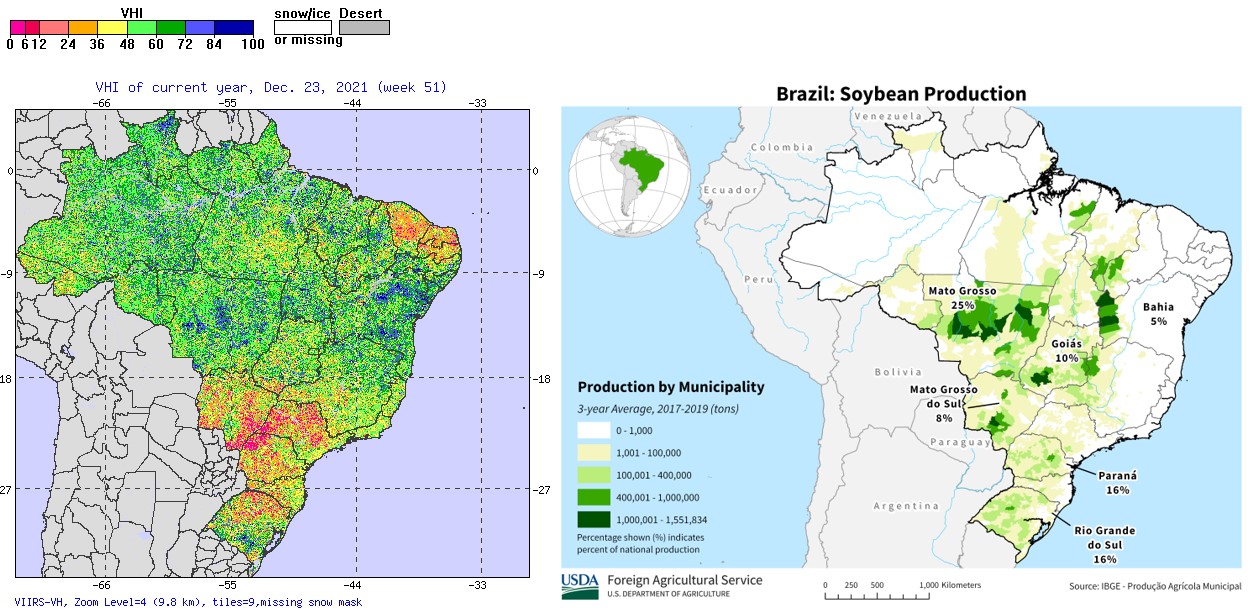

Major growing areas in Brazil displaying better vegetation health than last year. The southern part of the country is dry and has spurred this rally into high gear. Don’t want to be overly bullish here, Jan crop report is 2 weeks away.

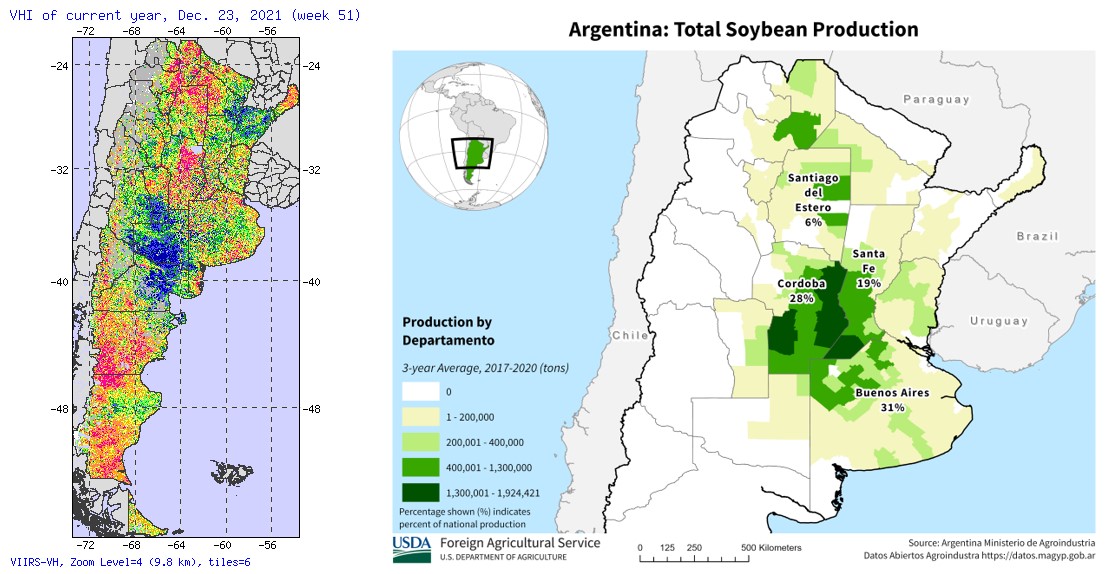

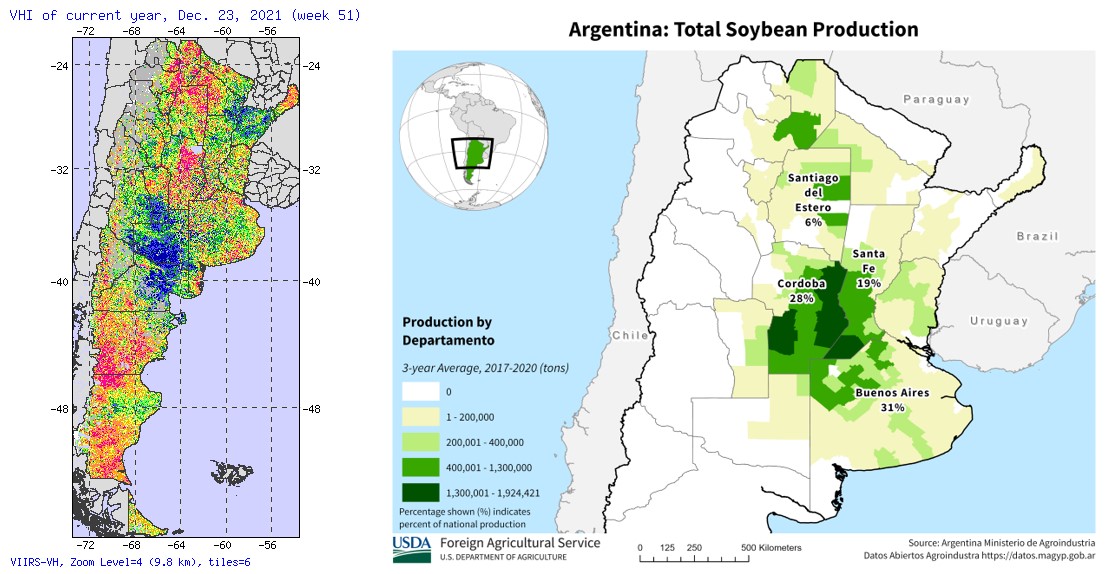

Argentina is a mixed bag compared to last year. The Buenos Aires Grain Exchange is expecting a record wheat crop in Argentina of 21.5 million tonnes this year.

Argentina is a mixed bag compared to last year. The Buenos Aires Grain Exchange is expecting a record wheat crop in Argentina of 21.5 million tonnes this year.

Major growing areas in Brazil displaying better vegetation health than last year. The southern part of the country is dry and has spurred this rally into high gear. Don’t want to be overly bullish here, Jan crop report is 2 weeks away.

Argentina is a mixed bag compared to last year. The Buenos Aires Grain Exchange is expecting a record wheat crop in Argentina of 21.5 million tonnes this year.

Argentina is a mixed bag compared to last year. The Buenos Aires Grain Exchange is expecting a record wheat crop in Argentina of 21.5 million tonnes this year.