12/28/2022

Dec 28, 2022

Another day of strength in corn and soybeans. A relatively quiet overnight session gave way to a day session that featured money as an active buyer. Corn continued an impressive rally off its monthly low, ending the day nearly 50 cents above that mark. Soybean meal was the big mover today, up more than $15 on the most active contract. This was supportive to beans and corn. Managed money and funds are in the process of positioning themselves for month end/quarterly end/year end. On the fundamental side, there is not much to support this recent rally in corn. Ethanol and other end-users are not actively looking to purchase corn and the rail markets are quiet. Just a couple days after China announced they would be working towards opening up the country faster, they are already reporting that nearly 50% of passengers on incoming flights are testing positive for Covid. Truth or not, the markets need to take into consideration a possible retract to the announcement made earlier this week. Given where we ended the day on the charts, this is a spot to price some bushels, old and new crop.

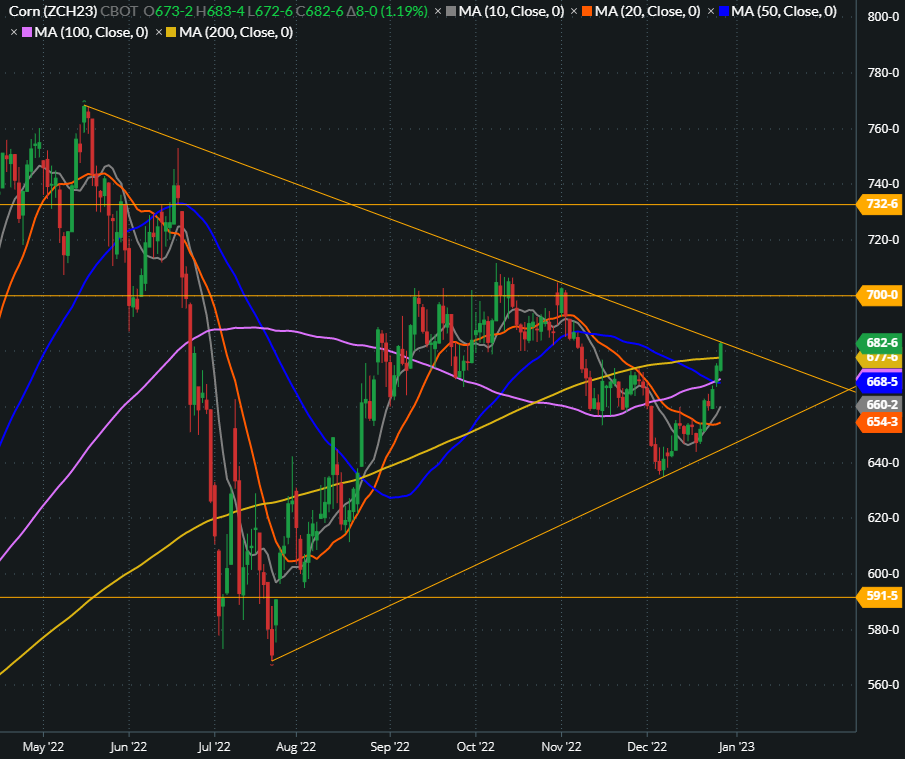

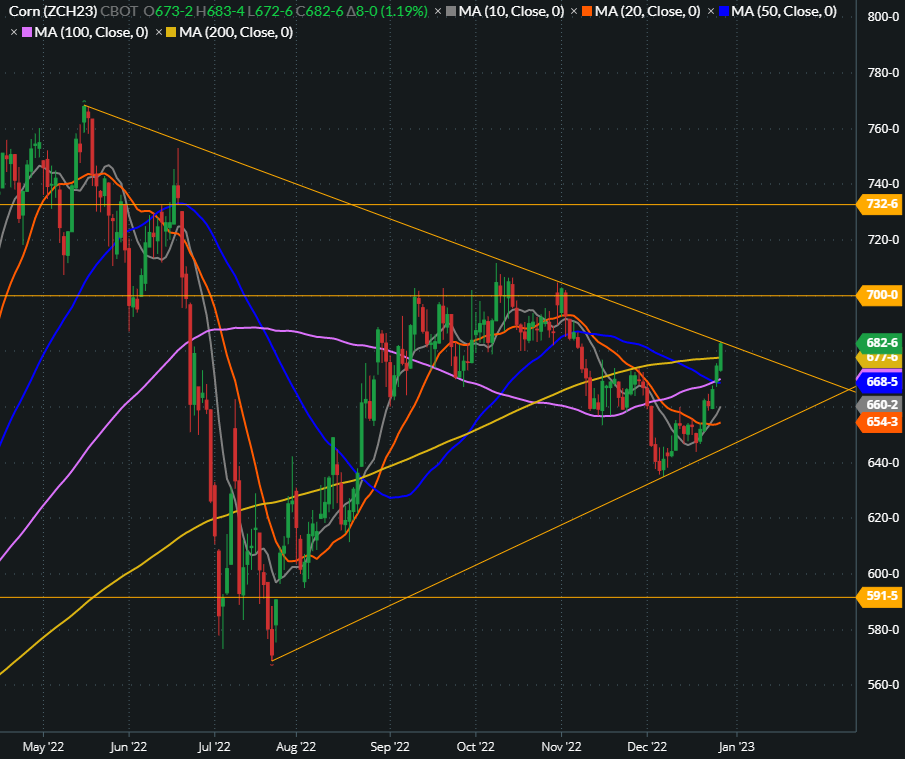

Corn ends the day above the 200-day moving average and pushed up against its long term overhead trend line. IF trade is able to break out of the wedge to high side, the next objective would be the November highs just above the 700’0 level. A failure here would see a sell-off likely down near the 20-day moving average at 654’3.

Corn ends the day above the 200-day moving average and pushed up against its long term overhead trend line. IF trade is able to break out of the wedge to high side, the next objective would be the November highs just above the 700’0 level. A failure here would see a sell-off likely down near the 20-day moving average at 654’3.