12/30/2021

Dec 30, 2021

Corn and soybeans down hard one day prior to the final trading day of 2021. Funds and speculator money were the big buyers during this rally and with everybody long, there were no buyers left and the market was caught long. Algorithms kicked in to race each other out of length. Adding some fuel to the fire today, weather forecasts for South America improved greatly, with dry areas now showing possibilities of receiving over two inches of rain, triggering further sell-off. The only bright spot in our weekly export sales was corn, which outperformed the top-end of trade estimates with 1.25 million tonnes sold. Soybean and meal sales disappointed and came in below target with 524k tonnes of beans and 69.5k tonnes of meal sold. The report garnered some early buying interest for corn but the market eventually rolled over, giving into spill-over weakness from soybeans. Reminder: Glacial Plains will be closed tomorrow for New Year's Eve. Grain markets will operate a regular schedule and you have the option to price grain tomorrow if desired. We would like to thank all of our patrons and customers for another fantastic year and we look forward to serving your needs in 2022. Yearly grain price comparison off of today's close: March corn futures +1.12, basis +0.23, cash price +$1.35/bushel; March soybean futures +0.27, basis +0.32, cash price +$0.59/bushel

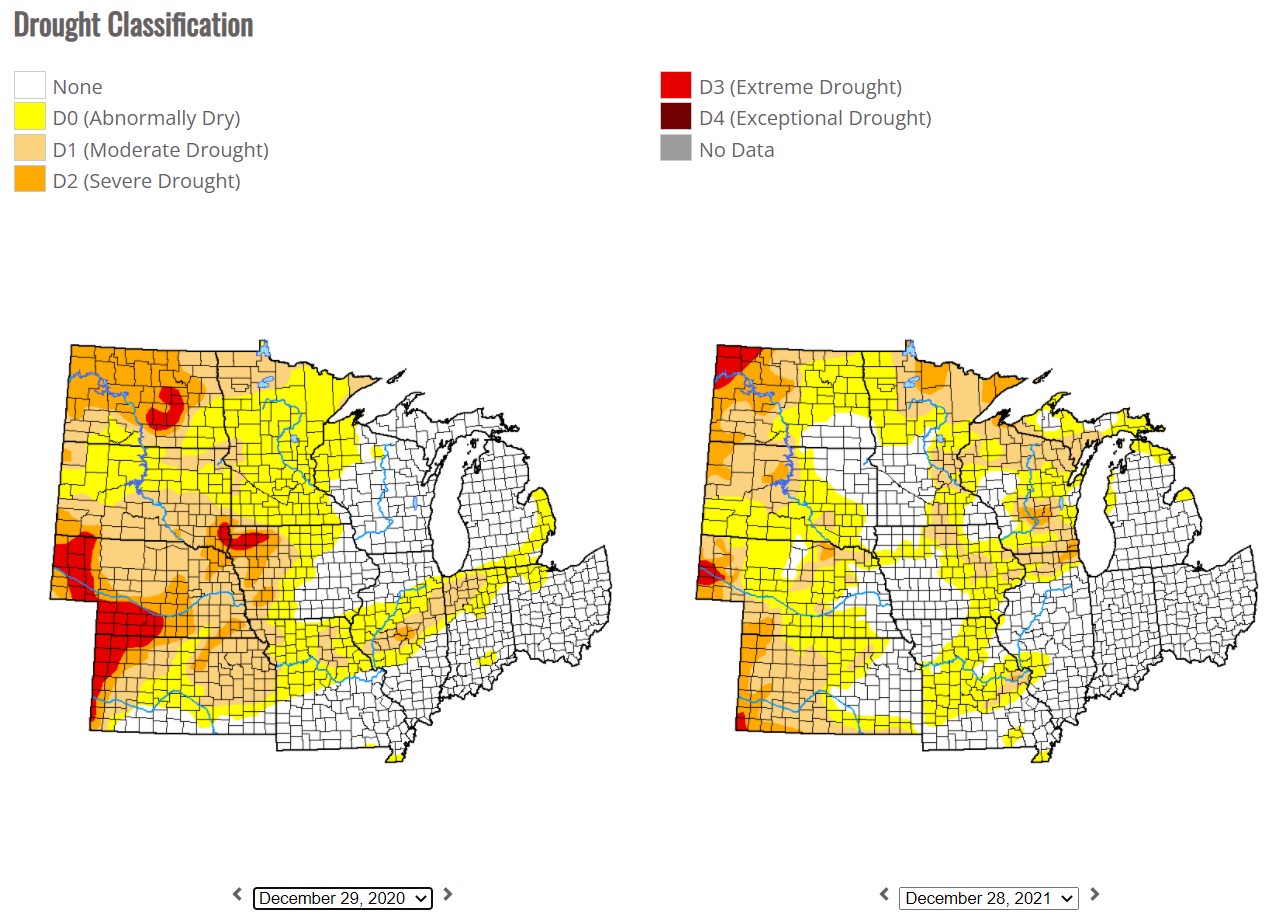

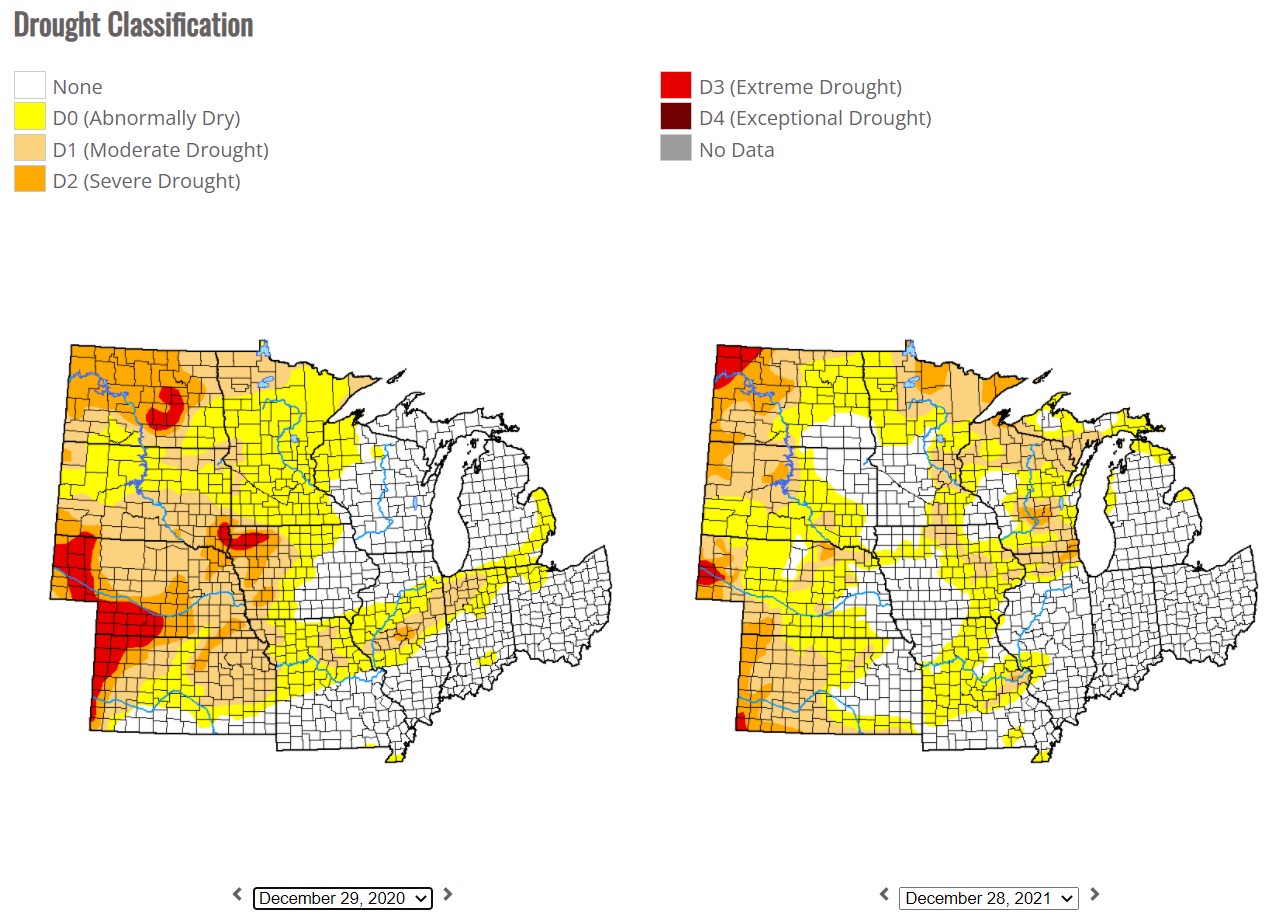

Been a while since we looked at the drought monitor. The grain belt is heading into 2022 in much better shape compared to how we started 2021.

Been a while since we looked at the drought monitor. The grain belt is heading into 2022 in much better shape compared to how we started 2021.