12/9/2022

Dec 09, 2022

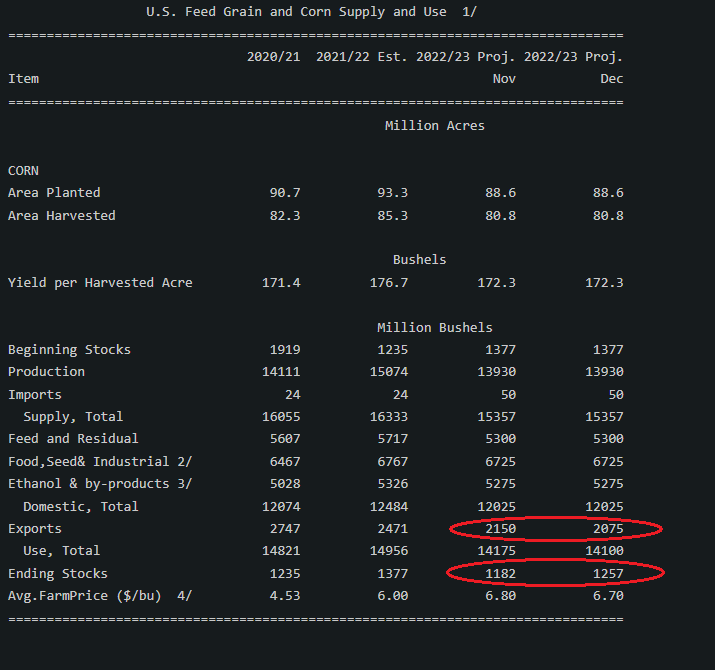

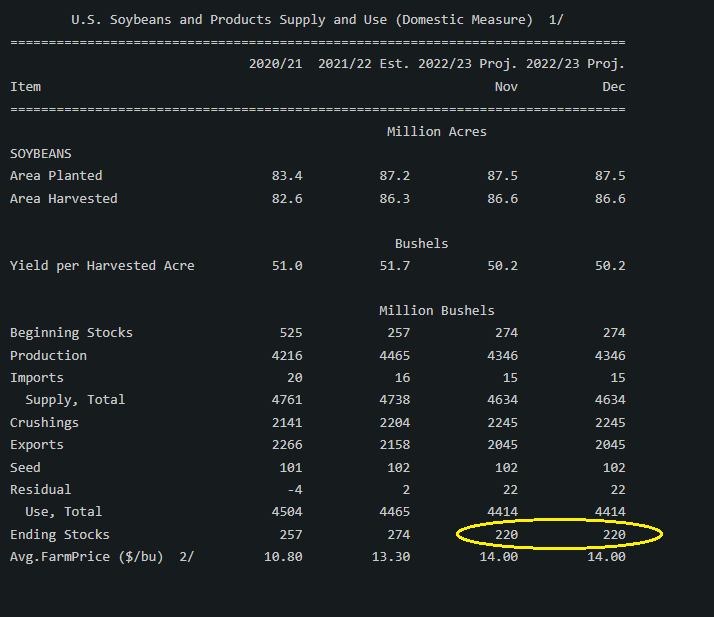

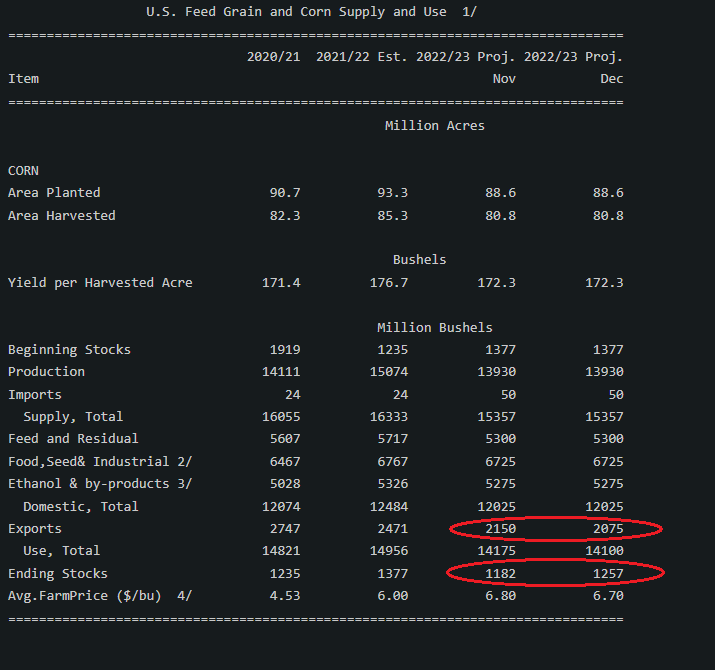

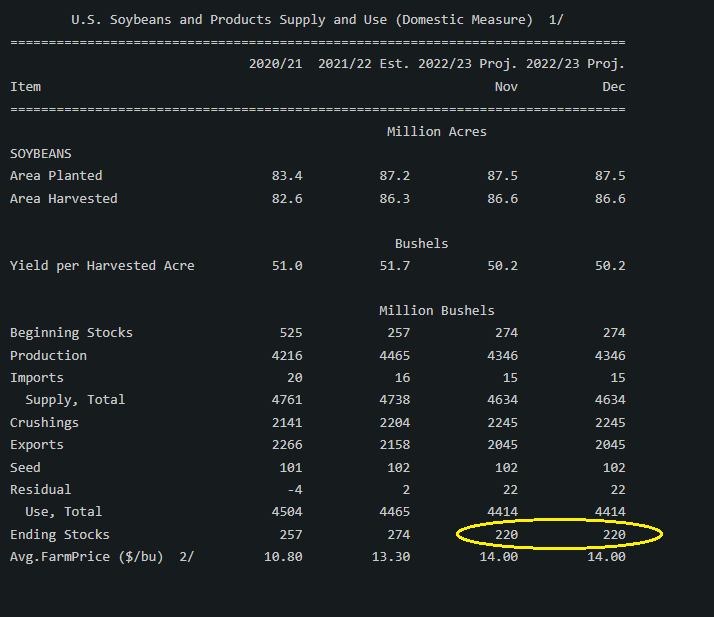

The WASDE report came and went with the excitement that is typical for this report in the final month of the year. The USDA cut the corn export forecast by 75 million bushels but left the remainder of the balance sheet unchanged. There will probably be demand sectors revised lower further down the road. March corn traded its high mark for the week when the report was released before falling back to 1-2 higher trade. The corn board finished the week in mixed fashion. The USDA made no changes to the soybean balance sheet. This week's rally has shaken loose quite a few bushels of beans out of delayed-pricing and out of bins off of the farm. I think our growers did a great job this week getting soybeans priced at the top side of our 6-month trading range. We are still near the top end of that range so if you have not priced any beans in at these levels, look hard into it here. If trade can continue to push soybeans higher, we have hard resistance at $15.00 before we can target our upside gaps on the charts.