2/3/2022

Feb 03, 2022

Soybeans took a breather today, trading as much as 15 lower overnight but received a bit of a boost from the weekly export sales report to go into the coffee break with some upwards momentum. Some fast-buying right at the 8:30 open saw the March 22 contract touch 1560'0 but we failed to make a new contract high for the first time in 6 trading days. Soybeans covered a fair amount of ground today to a modest, mixed finish. Corn has been able to trail the beans on their rally but has been a very reluctant follower. We've mentioned that corn demand has been sluggish for a while and it feels like the market is finally starting to realize that. Ethanol margins are slim/breakeven and export business is routine. At 8am this morning, the USDA confirmed the cancellation of 380,000 tonnes of corn to China for the 2021/22 marketing year (about 15 million bushels). It's not uncommon to see cancellations this early in the year but the market was definitely not prepared for it. We will likely see more cancellations as we continue on but it wouldn't shock me to see a sale come back on a price break. Futures are well over-bought for corn and soybeans and need a correction. Weekly export sales were on the upper end of trade estimates for both corn and soybeans with 1.175 mln tonnes of corn and 1.096 mln tonnes of soybeans. Wheat sales were a dismal 58k tonnes, well underperforming the 200k tonne bottom estimate. The February WASDE report is due out this coming Wednesday, feels like it was eons ago we got our final production numbers for the 2021 crop. Trade should continue to settle going into next week's report.

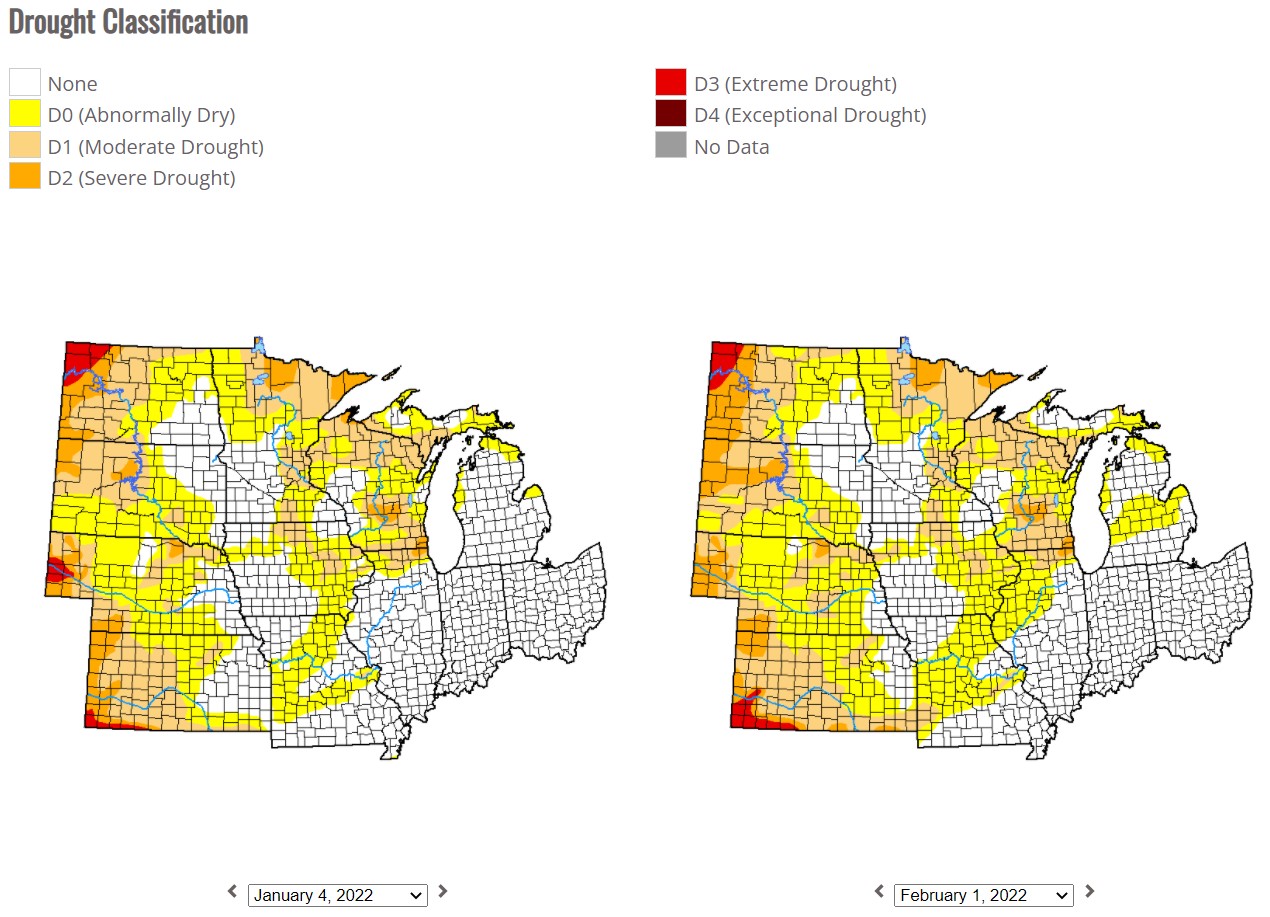

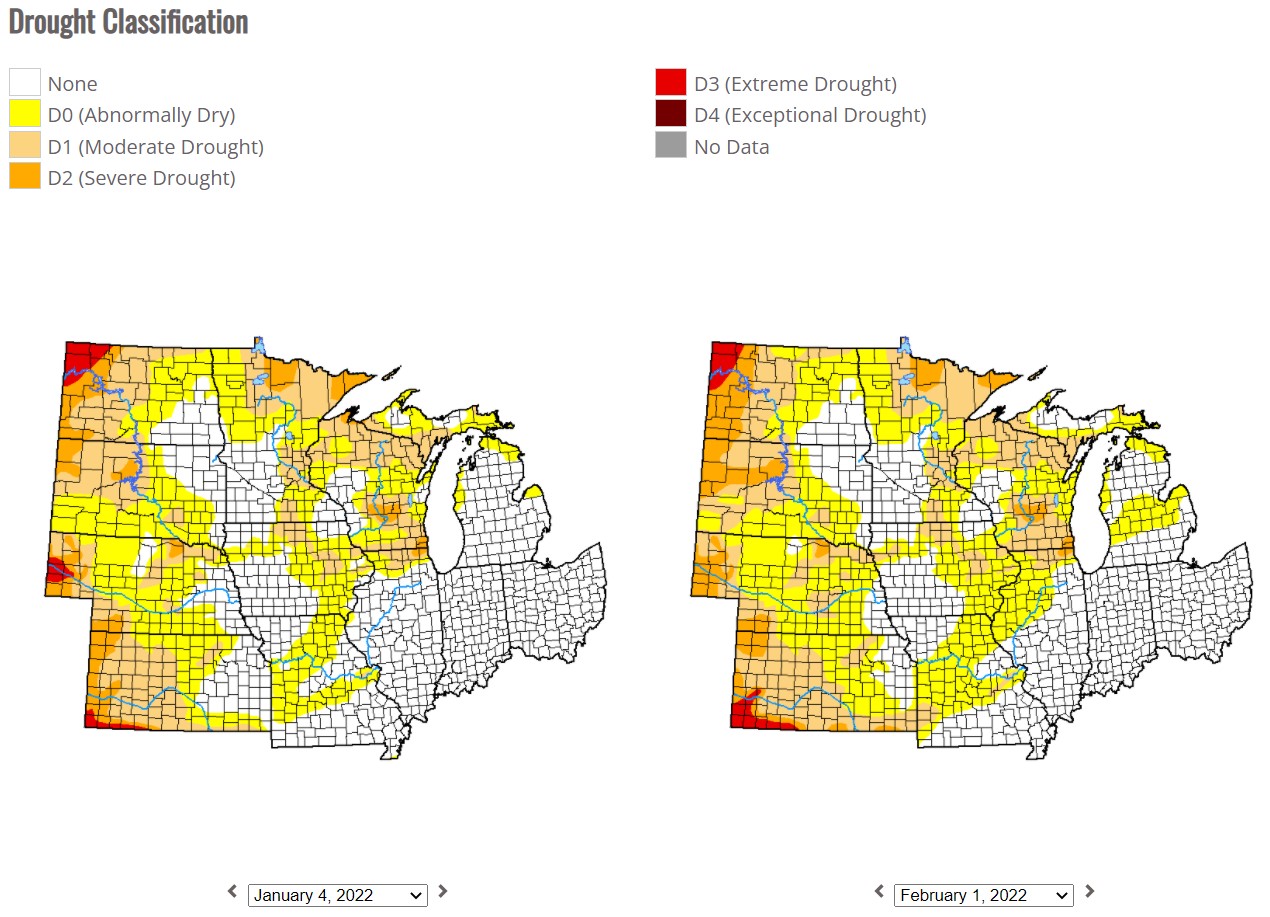

Some slight degradation on the drought monitor over the past month.

Some slight degradation on the drought monitor over the past month.