3/1/2022

Mar 01, 2022

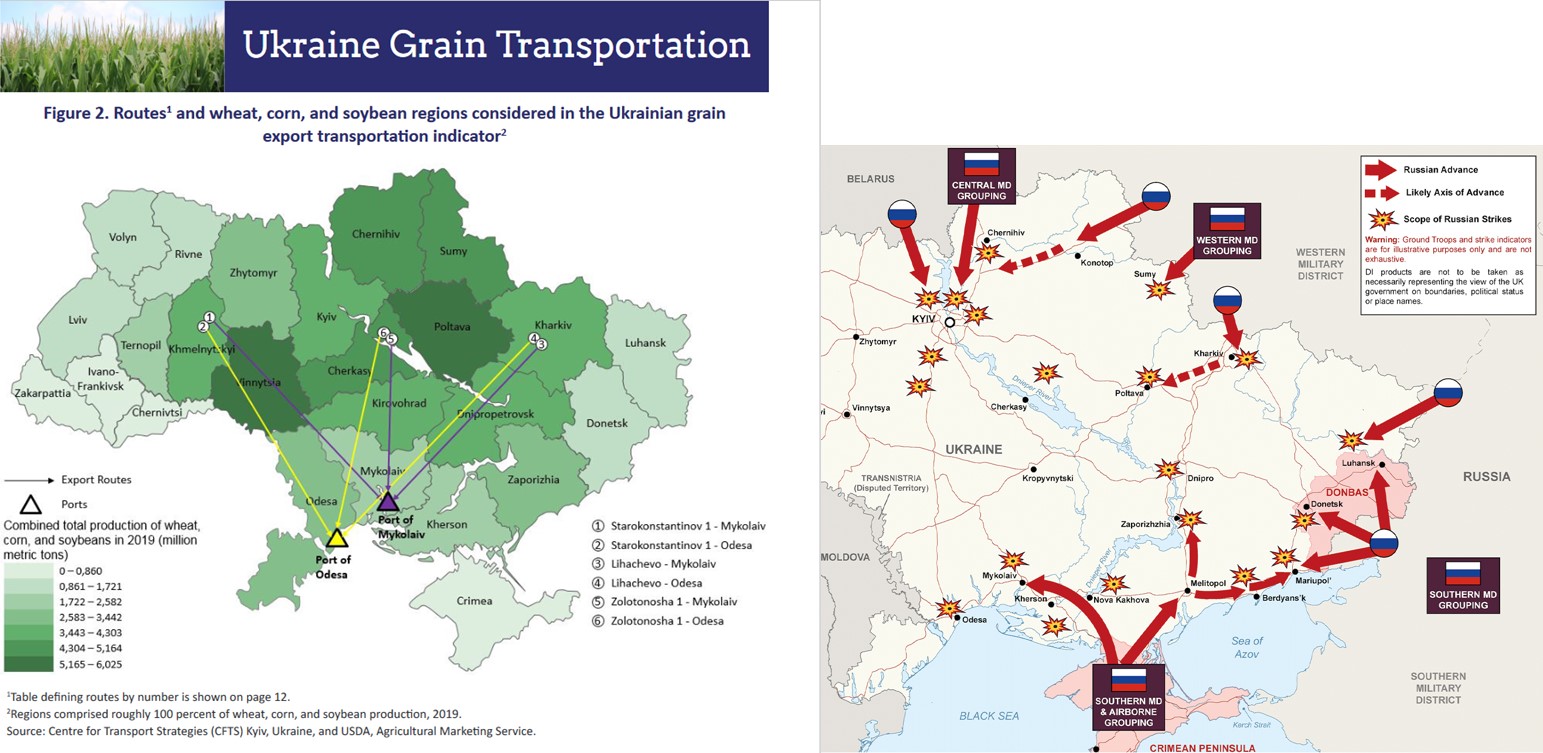

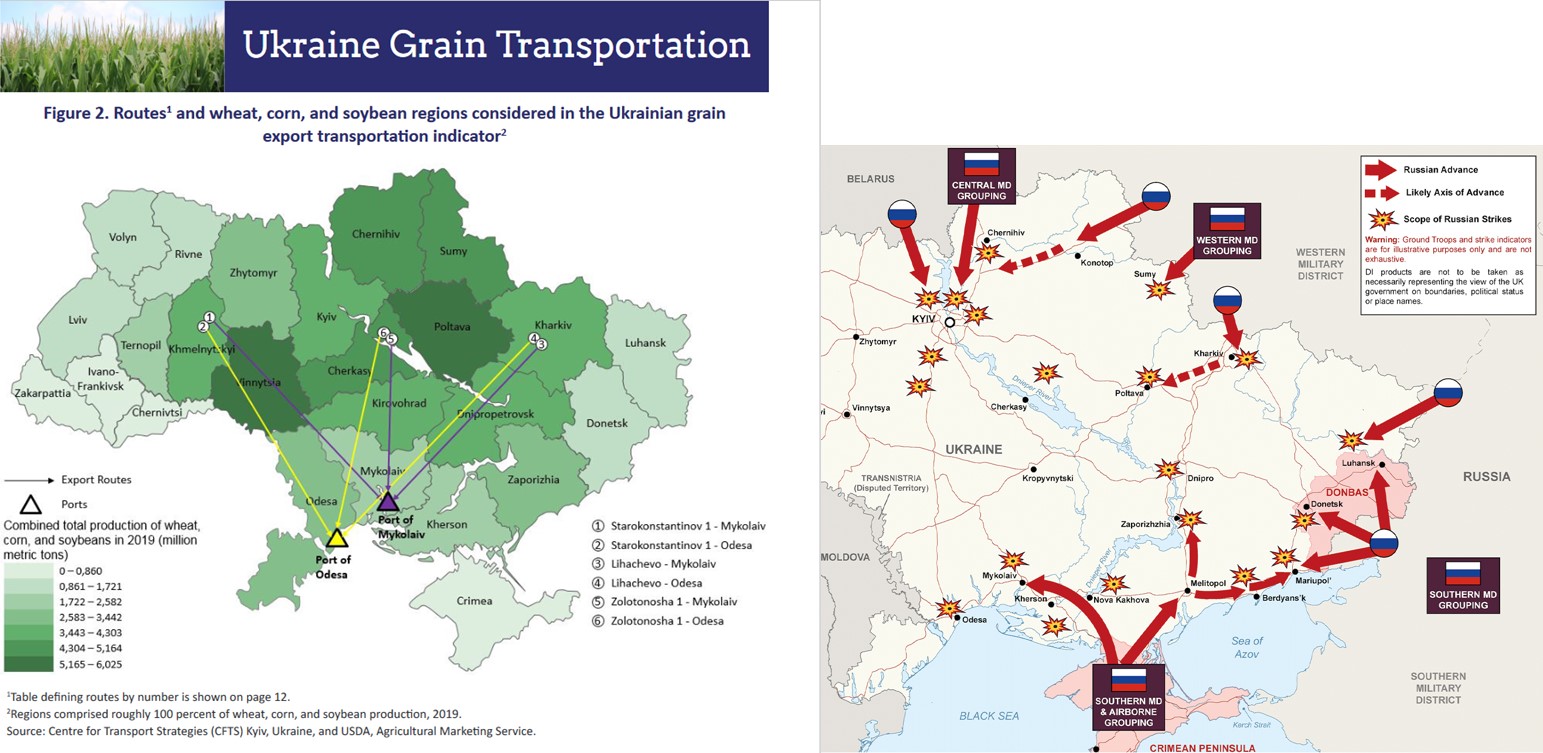

The market made another run higher today with corn bursting through, and closing well above, the 700 level and soybeans once again knocking on the door of 1700 futures. Most commodity futures are currently inverted with heavy risk premiums on the front end. Trade is already beginning to speculate the issues that may come with Ukrainian ag production this year. All of the ports on the Black Sea are currently shut down and some also damaged meaning no exports are currently exiting the country as a result of the on-going Russian military invasion. The biggest question is "What will Ukrainian farmers do?" No Ukrainian market means no incentive to plant a Ukrainian crop. May corn finished limit higher for the second consecutive day but in this atmosphere, no one knows for sure what tomorrow may bring. $7.00 corn and $16 beans are what I consider good bench mark cash price levels but we definitely do not want to sell out of old crop here. The US corn export market is perking up a bit and showing some signs of life as users look to secure coverage on a global scale. The rumor mill is also pumping out plenty of talk about new sales for US 2021 crop soybeans. Combining inflation, war, and a crop shortage in South America, this market is a whole new breed of animal that we won't soon forget and something that we likely reference in the future. At 8 a.m., the USDA announced 264,000 tonnes of soybeans for delivery to China in the 2022/23 marketing year.