3/10/2022

Mar 10, 2022

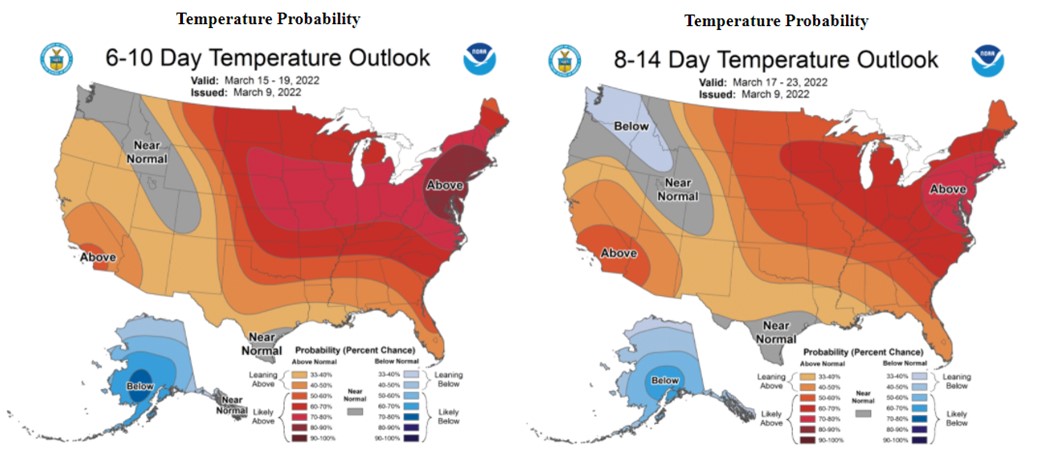

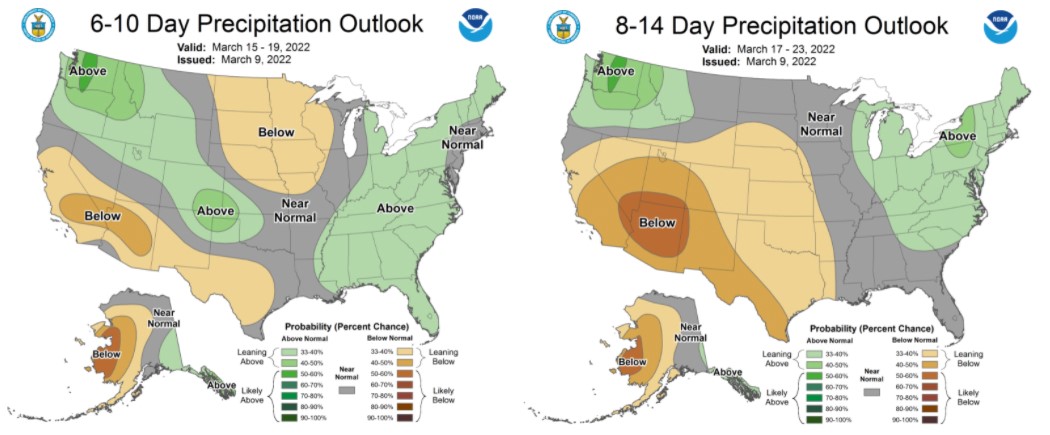

The market sold off yesterday after the USDA WASDE report put up "friendly-but-not-as-friendly-as-we-wanted" numbers for trade. Today, they had reason to buy back in with Brazil's CONAB making cuts to their expected soybean production and export numbers. Trade was also emboldened by the weekly net export sales report which showed strong numbers for old crop, especially corn. Corn outperformed the top trade estimate of 1.2 million tonnes sold by a large margin, posting 2.144 million tonnes sold last week. Soybeans outperformed expectations, as well, with 2.204 million tonnes sold versus the high estimate of 1.7 mln tonnes. Wheat continued to reel back after a historic bull run. The WASDE report turned out to be negative for wheat and Egypt (world's #1 wheat consumer) announced late yesterday that they were out of the market until the end of the year claiming sufficient reserves and a satisfactory domestic wheat crop to be harvested in April. Depending on the class, wheat has now traded anywhere from $2.60-$2.80/bu off of the highs set late last week. We don't hear much about South American weather anymore which means any sort of risk there is likely priced into the market at this point and our own weather now becomes more important. It appears spring will finally arrive and we will begin to thaw next week following a final dire attempt by winter to hang on for the next couple days, yet. Continue to utilize sell orders to take advantage of the volatility in this market.