3/14/2024

Mar 14, 2024

Corn and soybeans gave the markets a bit of a gut check and perhaps a short-term signal that our rallies will pause for the time being. Soybeans went wild after the morning break when May beans traded up to 21 cents higher and the November contract nearly touch $12. Corn just couldn't find any way to trade higher and that weakness spilled over into soybeans. Beans fell away from their highs violently and we were quickly bogged down in 1-2 cent lower trade. Corn did not get much help from trend line or 10-day moving average support. The USDA confirmed an export sale this morning of 100,000 tonnes of corn to Mexico for delivery in the 2023/24 marketing year. Mexico has stepped up in a big way purchasing corn from the U.S. this year and has taken some of that business that's lacking from China. Our corn market would look much different if they weren't buying the volume that they are. Weekly export sales were solid for corn and at the top end of the trading range at 1.283 mln tonnes. Soybeans were on the low end at 376k tonnes.

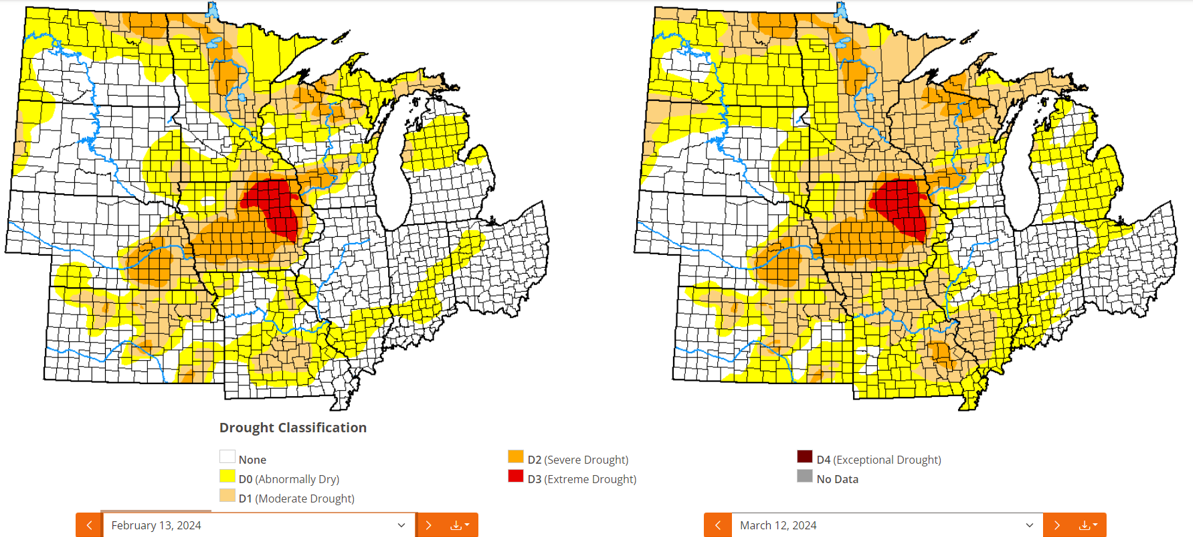

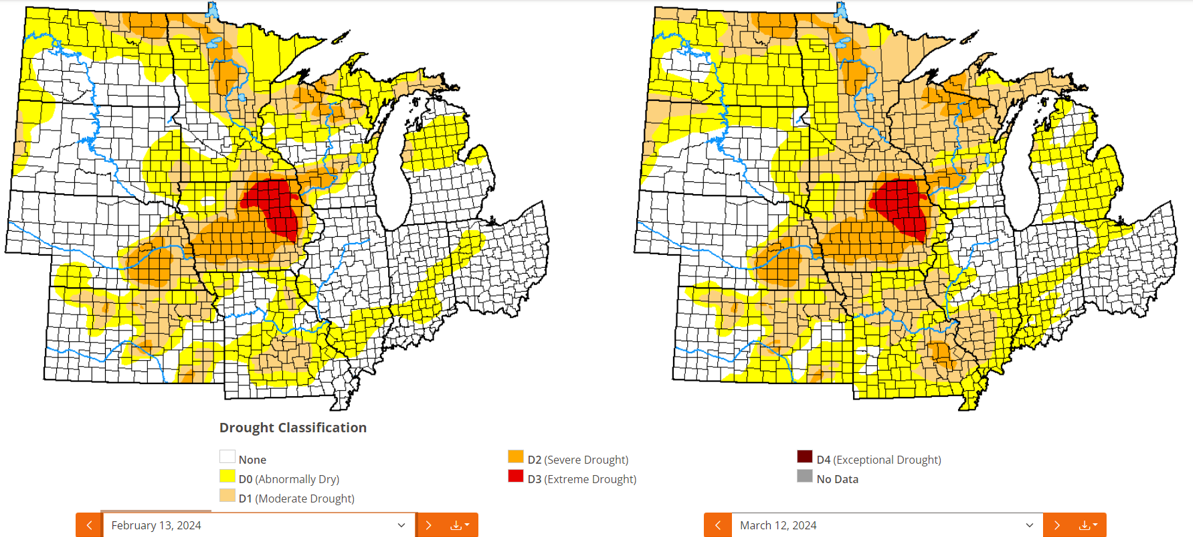

Following an open winter and above normal temperatures that look like they will continue, trade is starting to pay attention to moisture levels through the U.S. grain belt. Over the past month, drought area and severity has increased.

.png?lang=en-US)

Following an open winter and above normal temperatures that look like they will continue, trade is starting to pay attention to moisture levels through the U.S. grain belt. Over the past month, drought area and severity has increased.

.png?lang=en-US)