3/20/2023

Mar 20, 2023

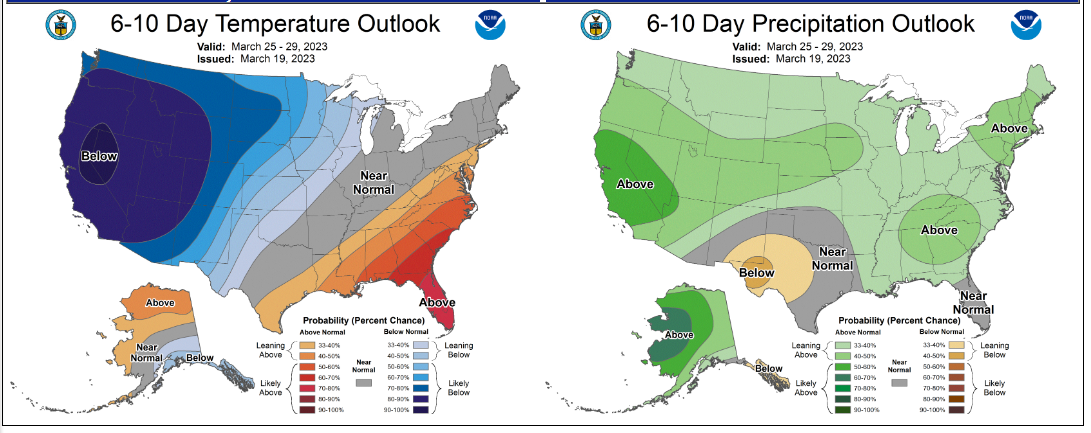

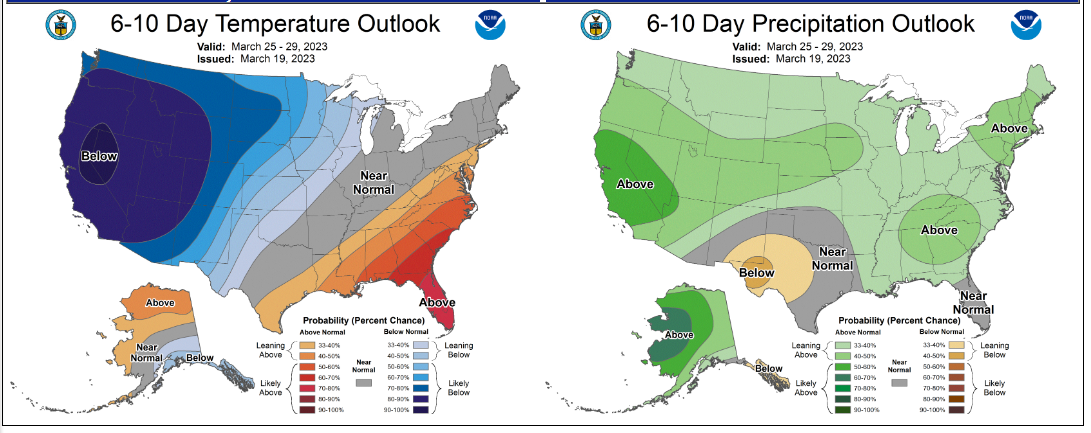

After some measurable rains in Argentina over the weekend, opening calls were lower for Sunday night. May contracts traded 9 cents lower for corn and 14 cents lower for soybeans. November soybeans traded below the $13 handle for the first time since early August last year. Soybeans ended mixed with gains on the front end, May traded steady 8-9 higher from mid-day into the close. Corn struggled to follow but was able to close only 1-2 cents down on the day. Weekly export inspections are finally beginning to pop higher for corn with 1.189 mln tonnes shipped last week. Soybeans showed a bit of recovery after some slow weeks with 717k tonnes shipped. A blizzard on Friday, the official start of Spring today, and the planting intentions report next week; just like that the year will already be 1/4 done with and the market will be looking to see how quick (or slow) farmers will be able to plant and it seems like the market always forgets that the American farmer plants faster every year. Have orders working and be ready to make sales if we get a delayed planting rally! Values near $6.45 cash corn, $5.45 new crop corn, $14.60 cash soybeans, and $13.00 new crop beans should be paid attention to!