3/28/2022

Mar 28, 2022

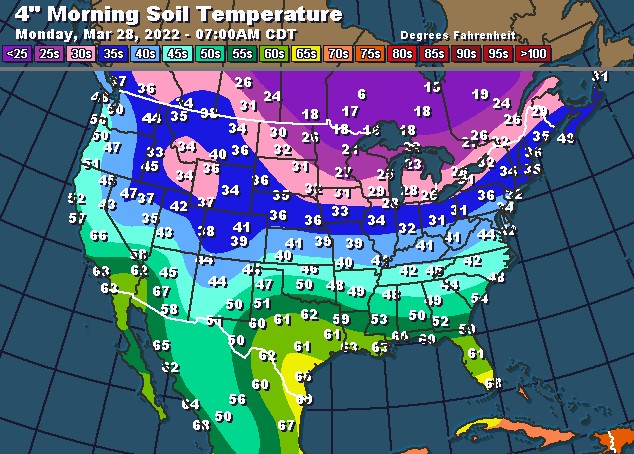

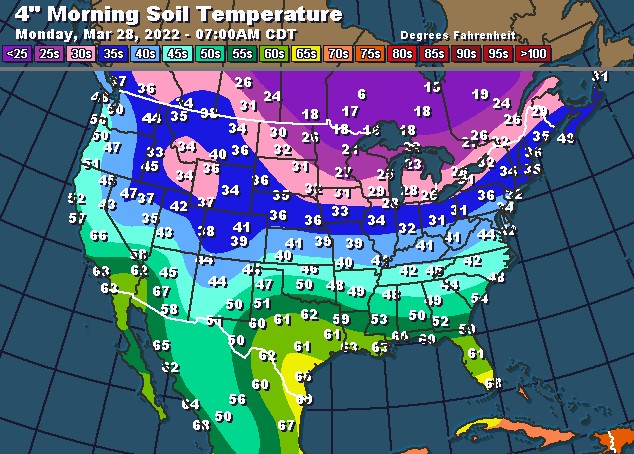

Huge risk off that began almost immediately at the 7:00pm open last night. Almost all of our active corn and soybean traded exclusively in the red today with the exception of the September and December 2023 corn contracts which managed to trade 1-2 cents higher. The USDA offered some information to chew on with a couple sales announcements at 8 a.m. this morning that included 132k tonnes of soybeans to China during the 2021/22 marketing year and 127,920 tonnes of corn to unknown split approximately 60/40 between 2021/22 and 2022/23 deliveries. There was a broad sell off across most commodities as the market starts to weigh new topics including some isolated bird flu cases and China suddenly instituting new COVID lockdowns in major cities. Weather outlooks and models are showing good precipitation ahead for almost all growing areas ahead of corn and soybean planting. There's a lot of opinions out there and a lot of thoughts of $20+ soybeans and $10+ corn but markets are cyclical. Soybean futures reached an all-time high of $12.90/bu back in 1973. It took approximately 35 years from that point for soybeans to finally trade in the teens (2008). While new all-time highs in the near future are certainly a possibility the reality is the higher our grain prices go, the easier it is for something to upset the market. Don't get us wrong, we love to see our growers receive big numbers for grain but we're never more than a stroke of a pen away from an abrupt ending. If corn makes a push towards the $8 handle, expect a debate to arise that includes the "Food vs Fuel" tagline and talks of ethanol mandates being waived for refiners.