4/1/2022

Apr 01, 2022

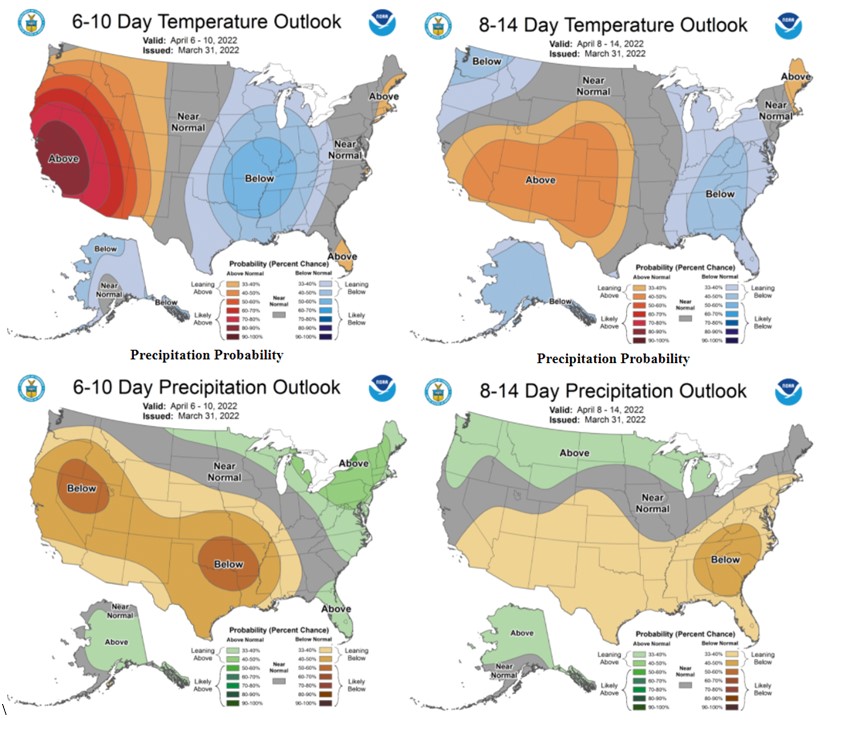

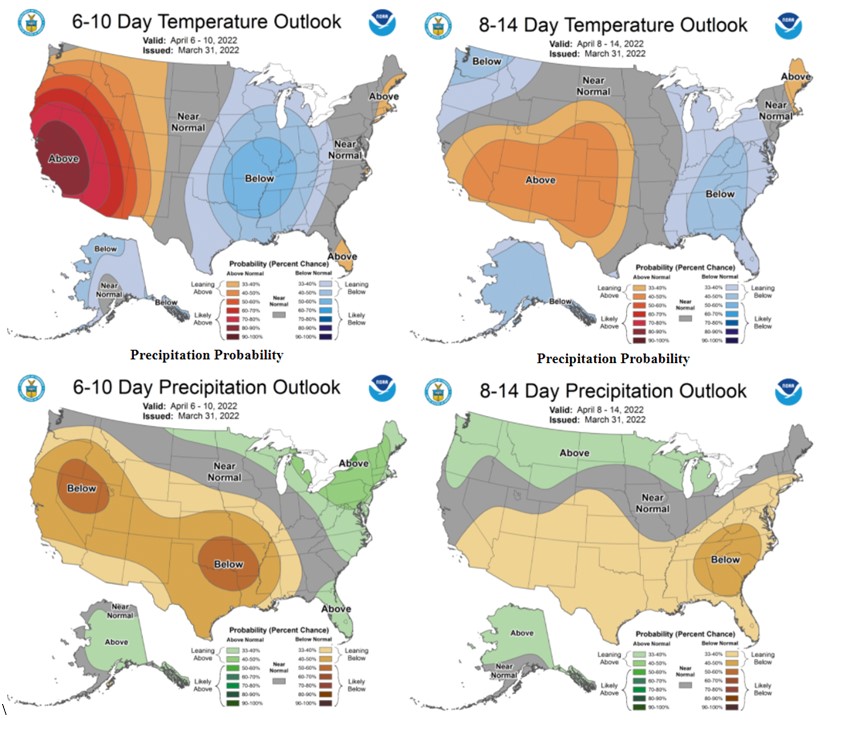

Short covering at the overnight open gave soybeans the appearance that they would bounce back after a sharp sell-off following yesterday's planting intentions report. They were able to hold in the green for the first few hours but eventually gave in to lower trade. Soybeans furthered sharply lower after the morning break when funds began liquidating their long positions, allowing futures to close below their 50-day moving averages for the first time since early December. Corn spreads have tightened greatly following yesterday's report with the May 22:July 22 spread narrowing to as little as an 11 cent inverse, this same spread was trading a 50 cent inverse less than a month ago. The July 22:Dec 22 corn spread has given up about 30 cents since the report release, from a 65 cent inverse to 35 cents. Anyone bullish should be concerned that wheat and corn did not respond to such a bullish acres report. We still have U.S. weather to price into our market but the drought monitor and forecasts aren't exactly market friendly. The market has been extremely quiet on anything that involves the South American crop after soybean bulls beat the Brazil drought drum for the entirety of 3 months solid. The combination of big U.S. soy acres and a much-better-than-expected Brazil crop would be a large nail in the coffin of the soybean bull market. China has also begun to sell out of their soy reserves almost immediately following our acres report, likely expecting to replenish those reserves at lower prices.