5/11/2022

May 11, 2022

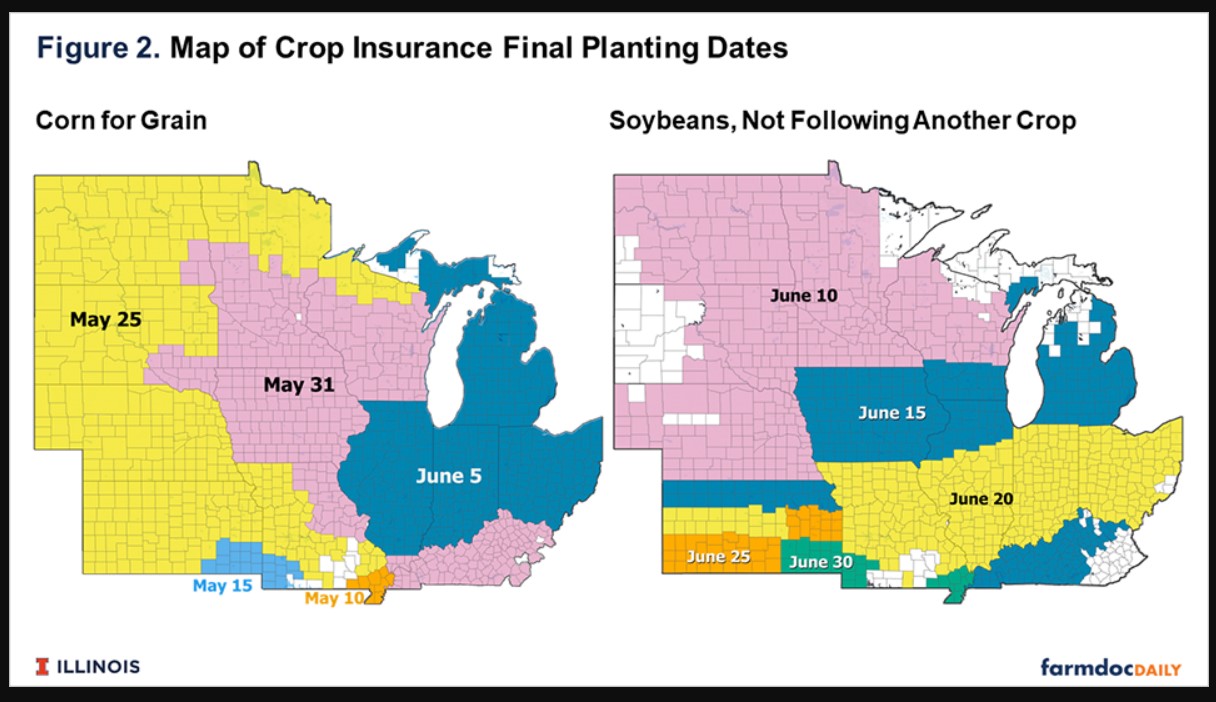

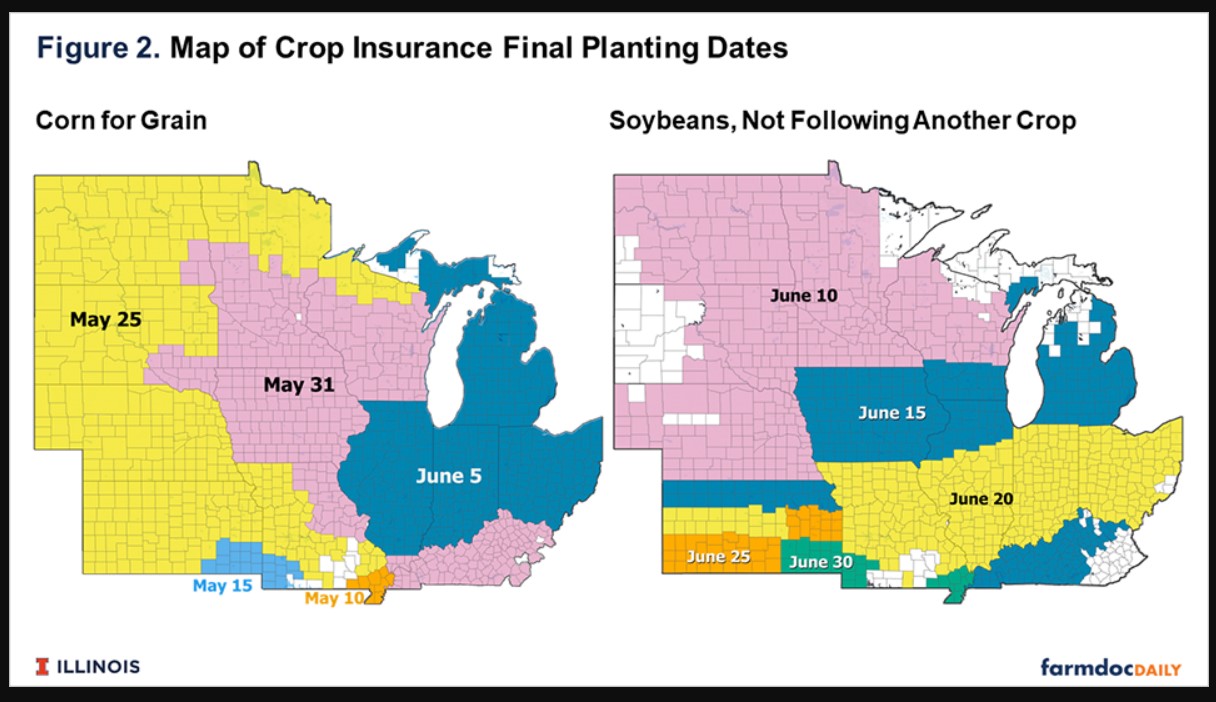

Corn, soybeans, and wheat all posted double-digit gains one day ahead of our monthly WASDE report. The July contract for corn settled the day near the middle of the range traded over the past two weeks, July soybeans settled on the low end of its 3-month trading range. With soybean acres already increased 3% year-over-year in our March planting intentions report and corn plantings becoming further delayed, farmers may turn more acres to soybeans. Front end contracts are already flirting with some major support levels and if no big headlines can rejuvenate the soy market nor the USDA provides anything fresh to boost the values, July soybeans could be heading towards the 1525'0-1550'0 area. A sizeable move lower in soybean futures would likely see basis improve with processors already collecting excellent margins in the crush. Weekly ethanol showed output up 22,000 barrels/day to 991,000 bpd and stocks up 253,000 barrels to 24.14 mln bbls. After today, the forecast shows an excellent possibility of a 7-day window for field work coming together and is probably all we need to get the necessary corn acres in.