5/12/2023

May 12, 2023

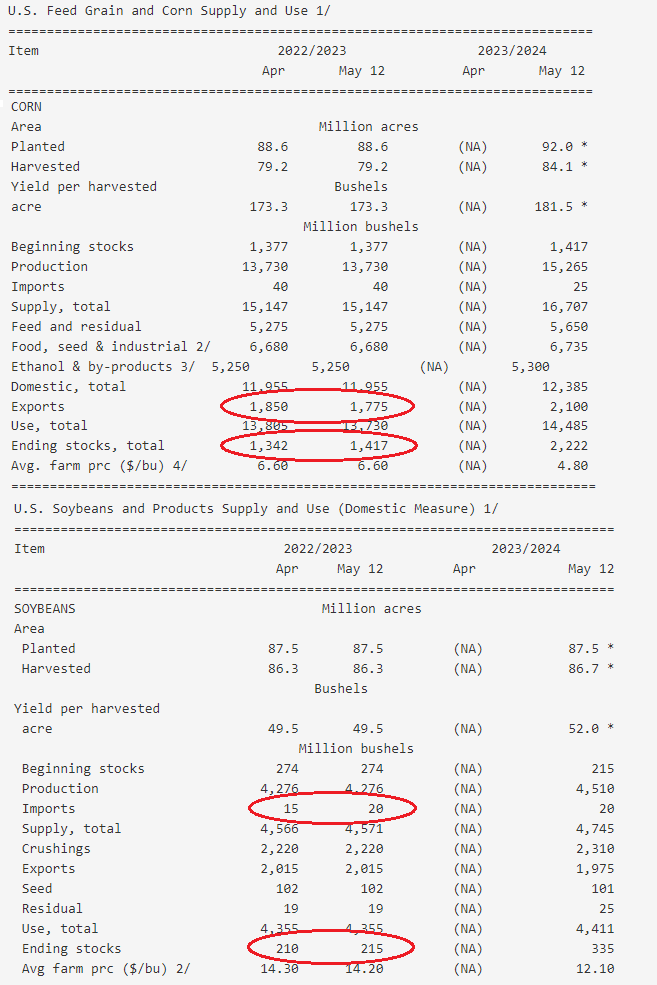

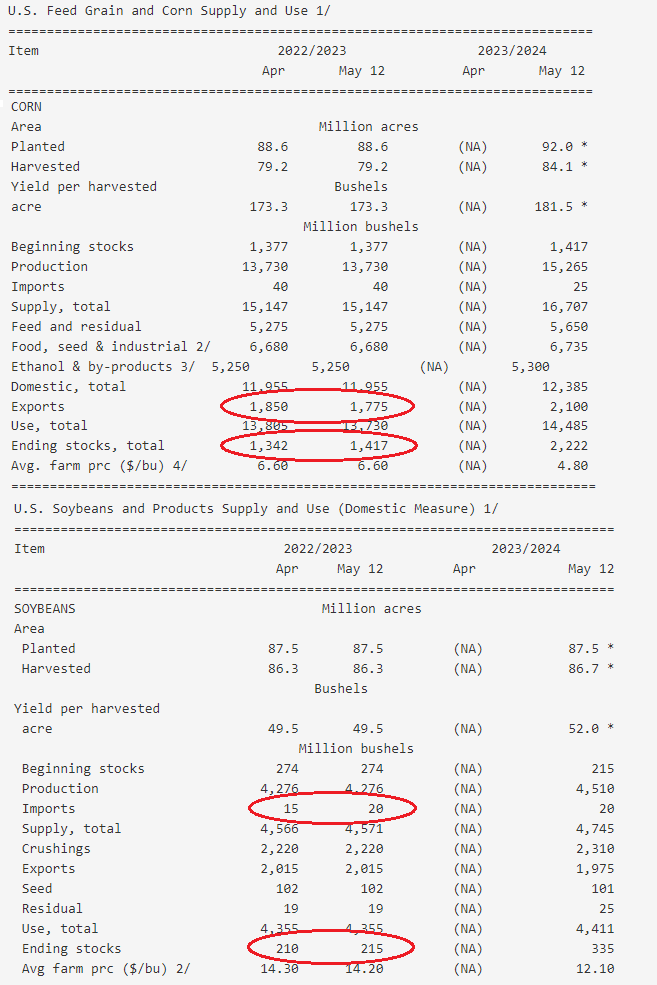

A largely negative WASDE report. USDA lowered 22/23 corn exports by 75 million bushels, increasing corn ending stocks to 1.417 bln bu. A couple things that stick out on the 2023/24 corn balance sheet: A 375 million bushel increase in feed use and an average farm price forecasted at $4.80/bu. On the soybean side, a small 5 million bu. bump in imports to take our 22/23 ending stocks to 215 mln bushels. For the 23/24 soybean balance sheet, it was pretty much plug and play. Steady demand numbers with a large increase in ending stocks from a bigger crop.