6/8/2022

Jun 08, 2022

Higher from the start overnight with spec money flooding in, mostly interested in buying the front months. Best described as somewhat "panic" buying following another night of some extremely severe weather in Nebraska and now talks of "ridging" bringing extra heat in June. This is a good opportunity to take advantage of the managed money trading headlines. After a cool, wet spring, it’s my opinion that our crop NEEDS this heat to get us back on track. We learned last year that dry weather with some extra heat isn't a bad thing. Those are the exact conditions these modern seed varieties are genetically built to thrive in. It's common knowledge that remaining dry will send the roots deep on the crop but we also learned last year that there is much less disease pressure present, as well. Combining the weather along with a Brazil corn crop that is now forecasted to be 25 million tonnes larger than last year, this 3-day rally should be quickly sold into. That's a lot of Brazilian corn to market and will be available at a price that could encourage imports into the U.S. (cheaper). Soybeans were able to hold through the session fairly close to their intraday highs but corn fading from early morning into today's finish takes away some of my confidence in this short-term move higher. I'm very comfortable with making a round of new crop sales at current prices.

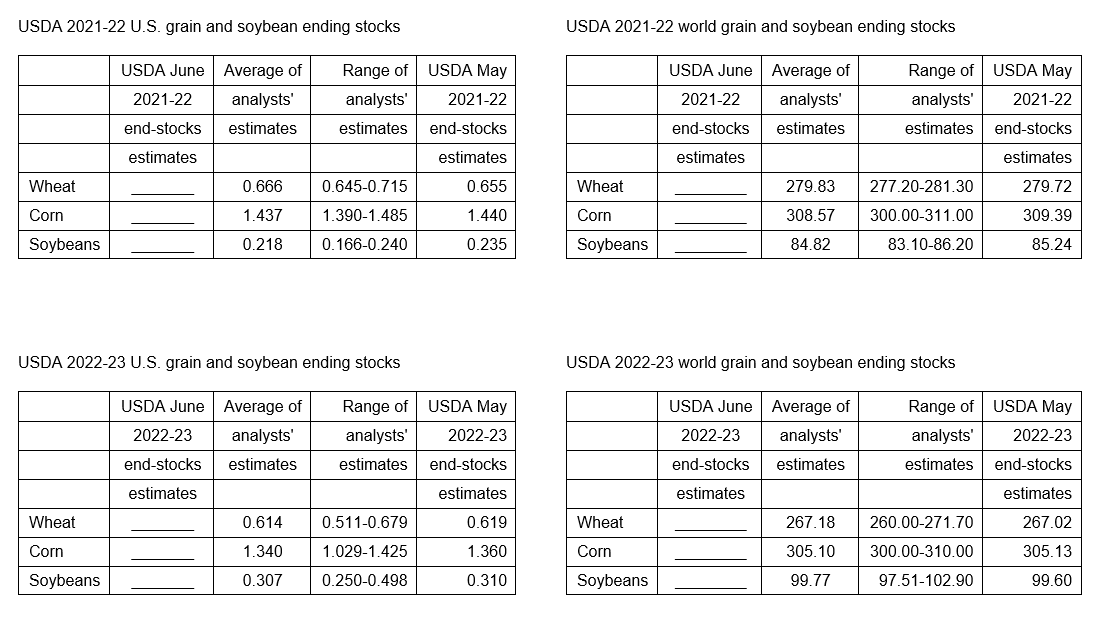

Full trade estimates for the June WASDE report

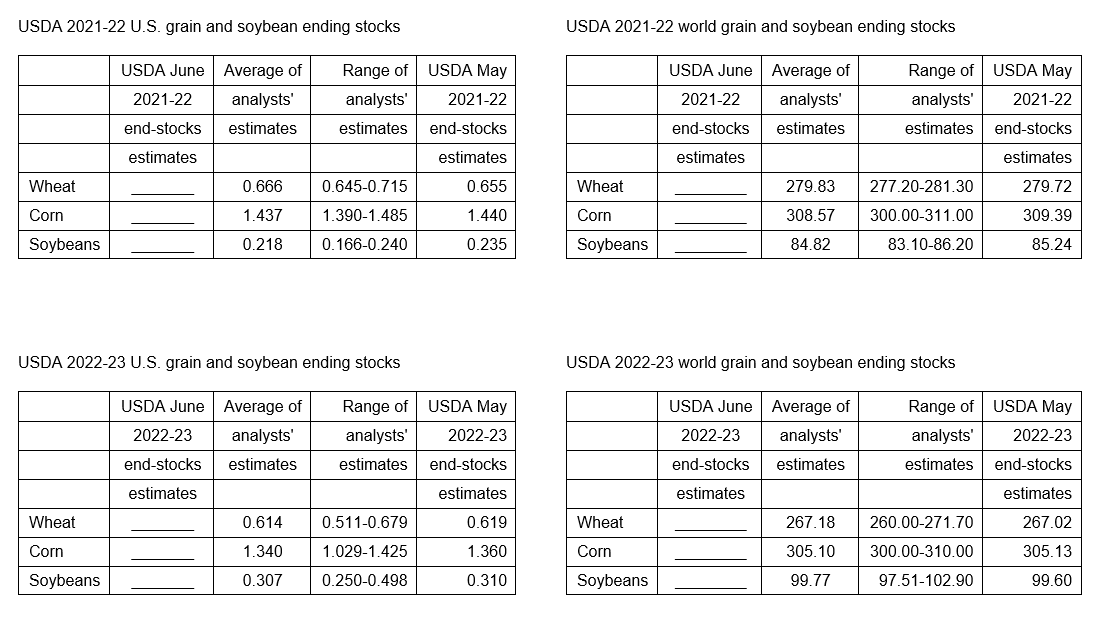

Full trade estimates for the June WASDE report