7/27/2023

Jul 27, 2023

Corn and soybeans were lower on Thursday with price action in corn relatively reserved, staying within a 10-cent range through most of the session. Soybeans were the risk-off move today with November completing an outside reversal lower on the chart, trading its lowest mark of the week, and ending the day down 22 cents, just below the $14 level. The USDA has been steady with 8 a.m. flash sale announcements this week. Yesterday morning, two soybean sales totaling 501,000 tonnes for delivery to unknown in 2023/24 was confirmed. This was followed up by an additional 256,000 tonnes confirmed for the same destination and timeframe this morning. The market typically assumes anything announced as "unknown" is China and the rumor today was that they were still active in the market. The weekly net export sales report did not feature any surprises. Old crop corn and soybean sales were mid-range with 314k tonnes and 199k tonnes sold. New crop sales were also mid-range with 336k tonnes and 545k tonnes sold. Not surprised to see new crop sales slow to start considering Brazil supply but demand slowly starting to pick up is a good sign.

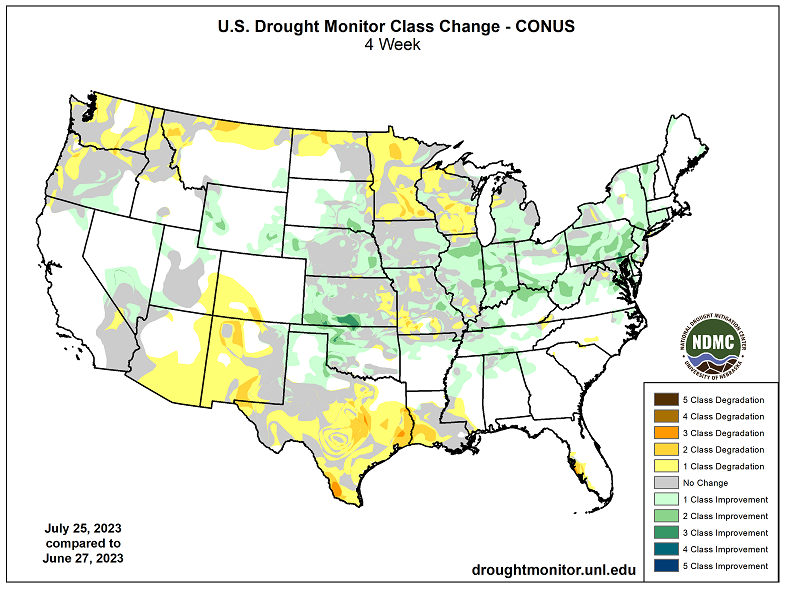

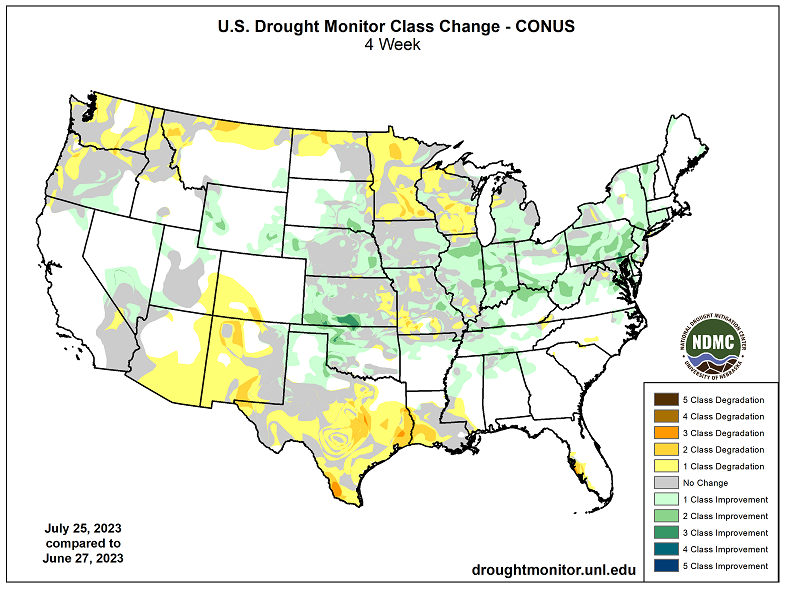

Drought conditions remained unchanged or improved across Iowa, Illinois, and Indiana through corn pollination. Combined this with the below average temps we had in July, average weather in August has a 178 bu/ac national average in play for the 2023 U.S. corn crop.

Drought conditions remained unchanged or improved across Iowa, Illinois, and Indiana through corn pollination. Combined this with the below average temps we had in July, average weather in August has a 178 bu/ac national average in play for the 2023 U.S. corn crop.