7/5/2022

Jul 05, 2022

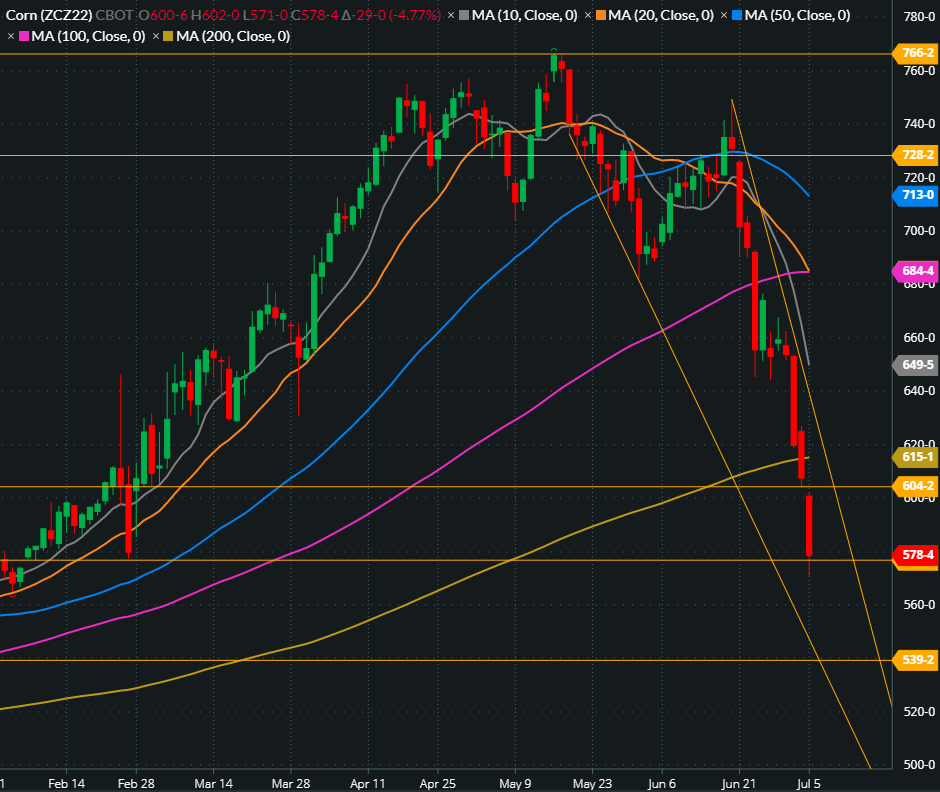

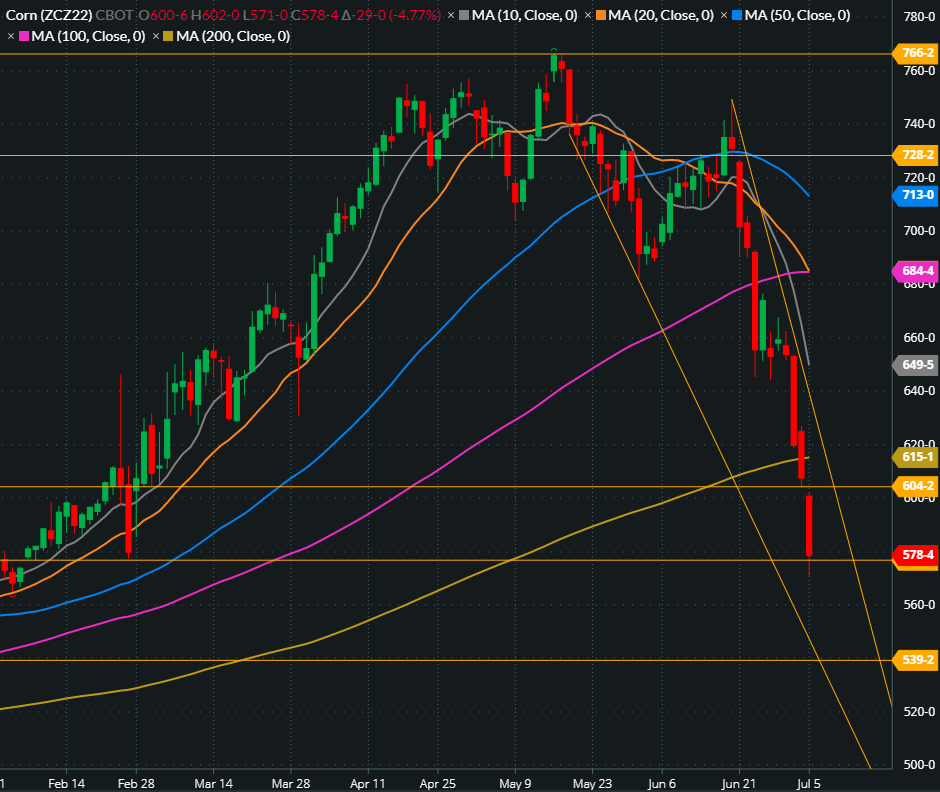

Huge risk-off following the holiday. Today featured something of rarity for corn and soybeans: an 8:30 hard open with no overnight trade. Regardless of sector, almost everything was down hard today across the broad market space. Grain futures are now near, or below, levels traded prior to the Russian invasion of Ukraine, war premium is officially priced out of the market. With the sudden free fall over the past 3 weeks, we've likely seen our highs for 2022 unless we have a serious weather issue. Compounding the negativity today was production estimates for Brazil corn set higher again and the weekly export shipments putting up some very weak numbers with corn, soybeans, and wheat all falling well short of their trade ranges. 677k tonnes of corn, 355k tonnes of soybeans, and 112k tonnes of wheat were inspected for shipment last week. Trade is expecting crop conditions to come in slightly lower again this week, staying in line with the trend.

Dec corn filled a gap left on the chart from early February this morning and finished the day above the top side of the old gap which may encourage some technical buying to come in. Also, we now have large breakaway gaps present on the charts from this morning’s hard open along with our initial gap lower overhead from two weeks ago. The set up is similar on other corn months and on the front soybean contracts.

Dec corn filled a gap left on the chart from early February this morning and finished the day above the top side of the old gap which may encourage some technical buying to come in. Also, we now have large breakaway gaps present on the charts from this morning’s hard open along with our initial gap lower overhead from two weeks ago. The set up is similar on other corn months and on the front soybean contracts.