7/6/2023

Jul 06, 2023

A rinse-and-repeat day in terms of price action and news as corn closes Thursday higher with double-digit gains out to July 24 and soybeans finish with with 11-22 cent losses on the day. The past two days have been good, corrective moves following trade's reaction to the USDA's surprise numbers for acres in the quarterly report last week. If looking to do new crop marketing, anything over $5 delivered for corn and anything close to $13.50 for soybeans should definitely be considered as we proceed through July. Given the past couple years, it's easy to understand why corn may be perceived as "cheap" by some but, in reality, the U.S. is still in the neighborhood of a 50 cent/bu premium to Brazil. Brazil's biggest issue right now is storage and logistics. The U.S. can thank the back-log of shipments out of Brazil for bringing any type of old crop business our direction. The weekly ethanol report showed production up 8,000 barrels/day to 1.06 million bpd. Stocks were off by 719,000 down to 22.26 mln barrels.

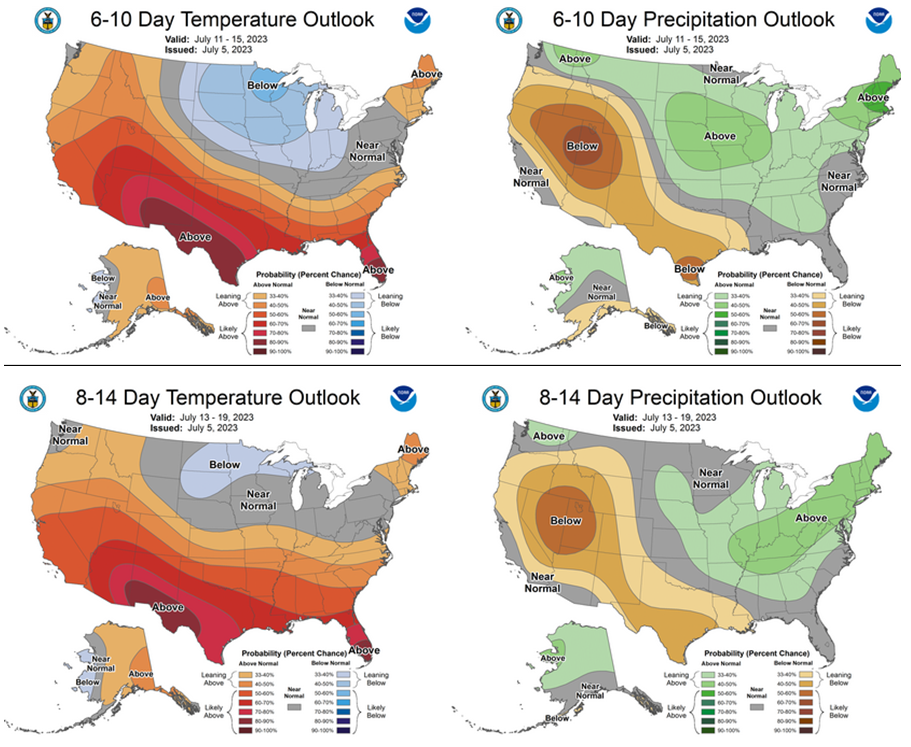

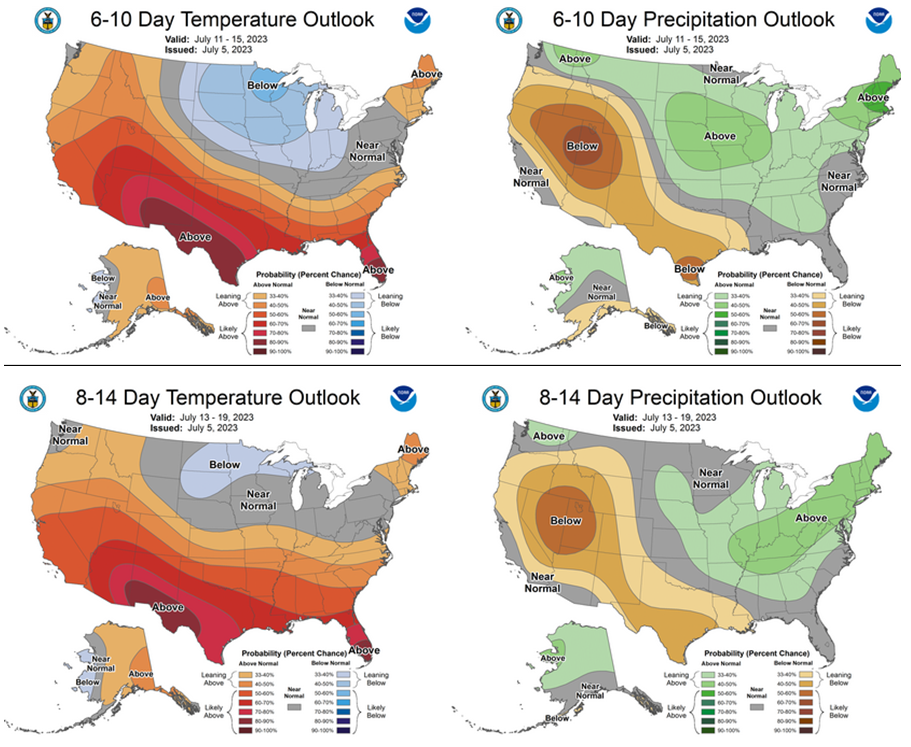

Weather outlooks appear favorable as the grain belt nears tasseling and pollination.

Weather outlooks appear favorable as the grain belt nears tasseling and pollination.