9/27/2022

Sep 27, 2022

Corn and soybeans firmed higher throughout the session but finish well off of their daily highs. December corn traded 12 cents higher and November soybeans 26 cents higher before retreating back to trade steady 2-4 cents for most of the day. Action looked very weak going into the close. Corn managed to hang on to finish with mixed closes of 1-2 higher out to July 23 and fractionally lower further out from there. Soybeans out to August 23 gave up gains in the last hour of the day to finish 1-3 cents lower. A couple things dictated price action today; the quick surge in buying was a knee-jerk reaction to higher rail freight values after a headline about low water levels on the river limiting barge freight this fall, triggering computers to put on soybean bull spreads. The U.S. dollar index also took a brief breather this morning, which looked encouraging to spec funds wanting to pick up some fresh length. Grains were sold off through the morning as the dollar rallied and flipped green. Trade has tried to force grains higher so far this week but these rallies cannot hold water if all it does is price the U.S. further out of the global market. Due out on Friday is the USDA's quarterly grain stocks report where we get our official ending stocks numbers for the 2021/22 U.S. corn and soybeans. The figures predicted by analysts are very close to the numbers printed by the USDA in this month's WASDE report.

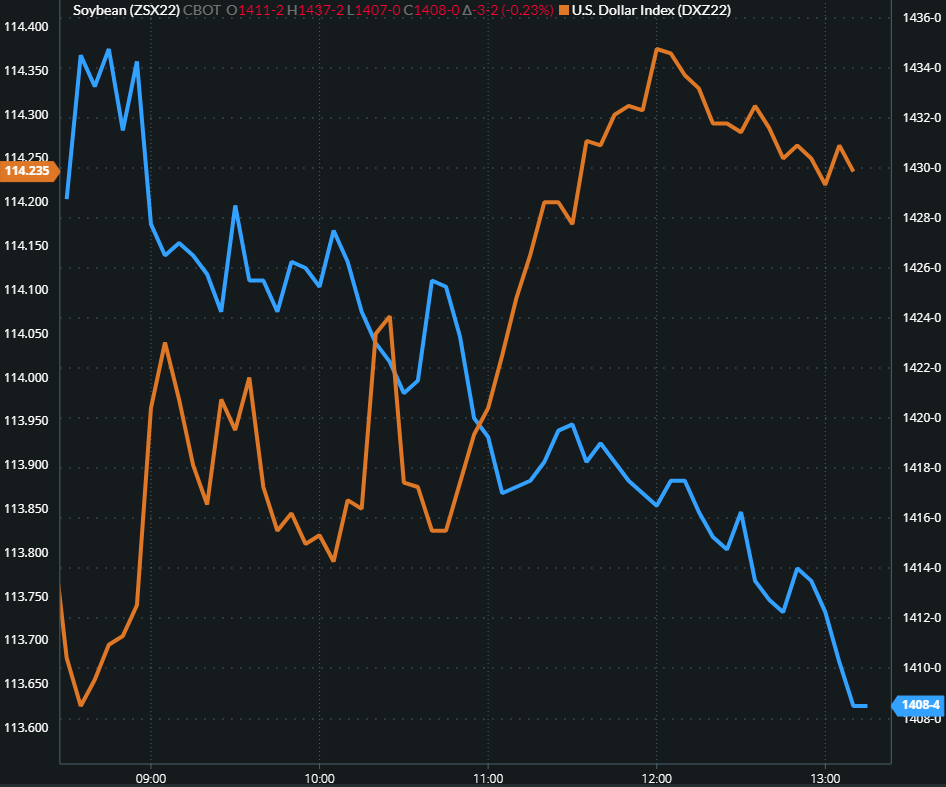

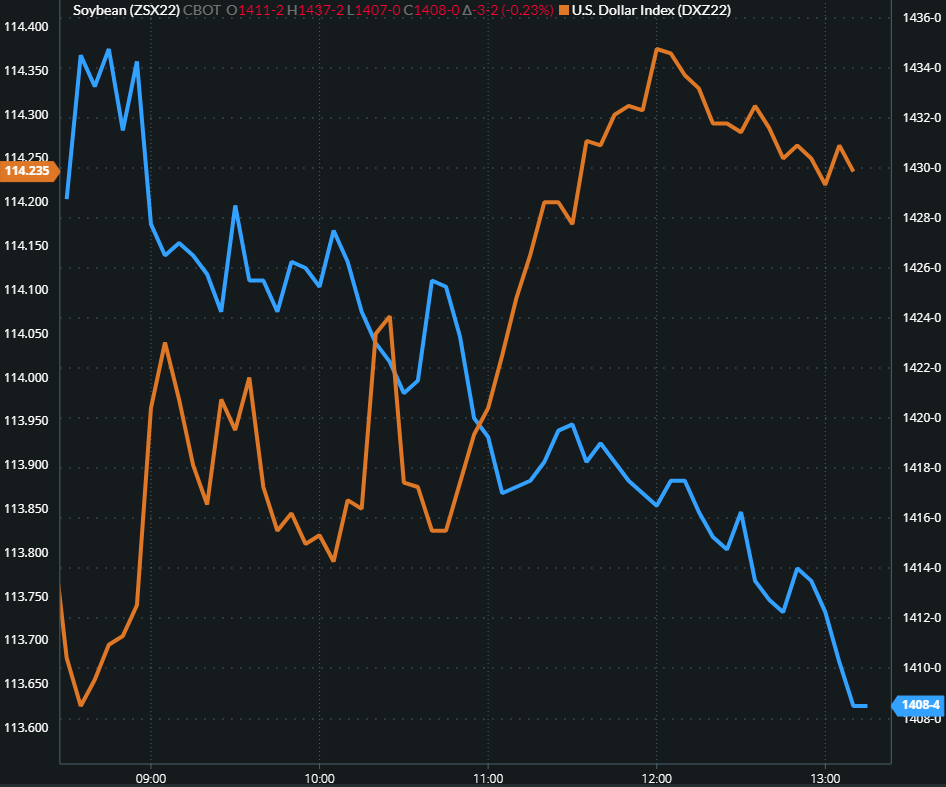

November soybeans (blue) vs Dollar Index (orange) 5-minute chart from today. As the dollar strengthened, grains weakened.

November soybeans (blue) vs Dollar Index (orange) 5-minute chart from today. As the dollar strengthened, grains weakened.