9/9/2022

Sep 09, 2022

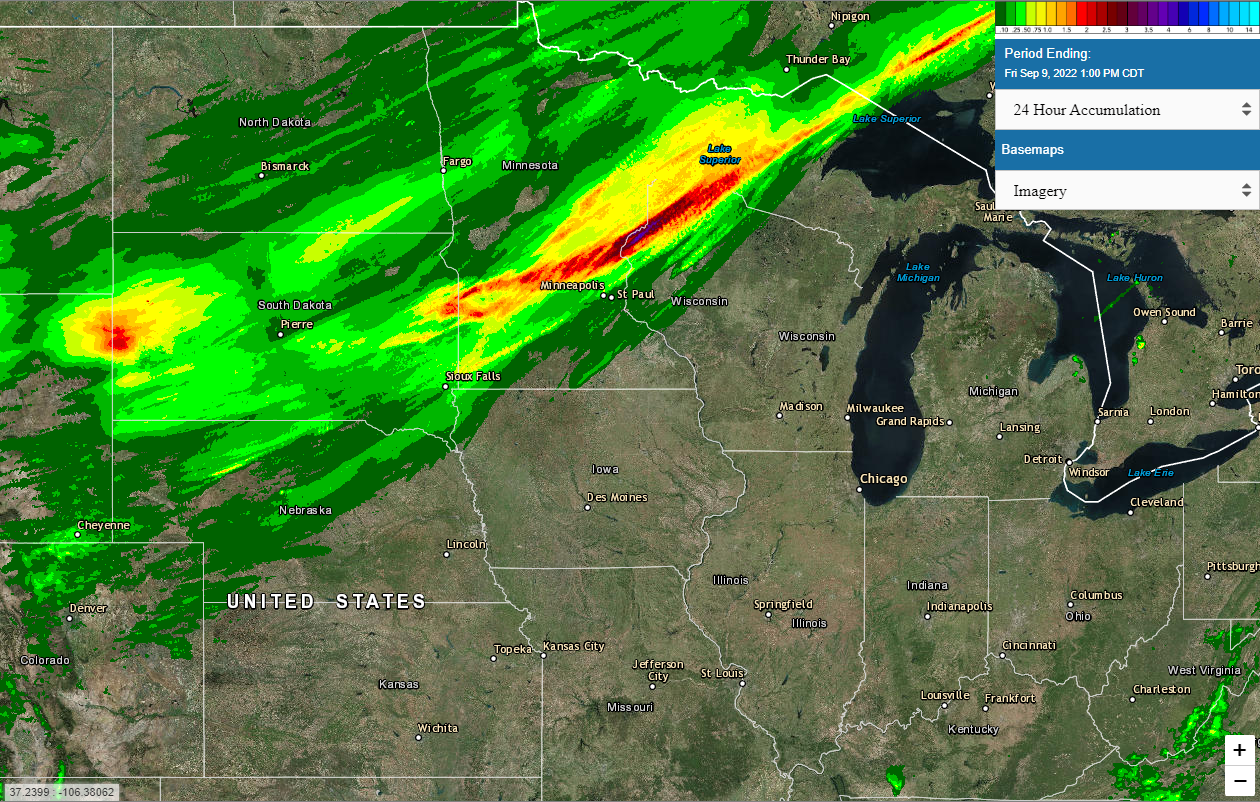

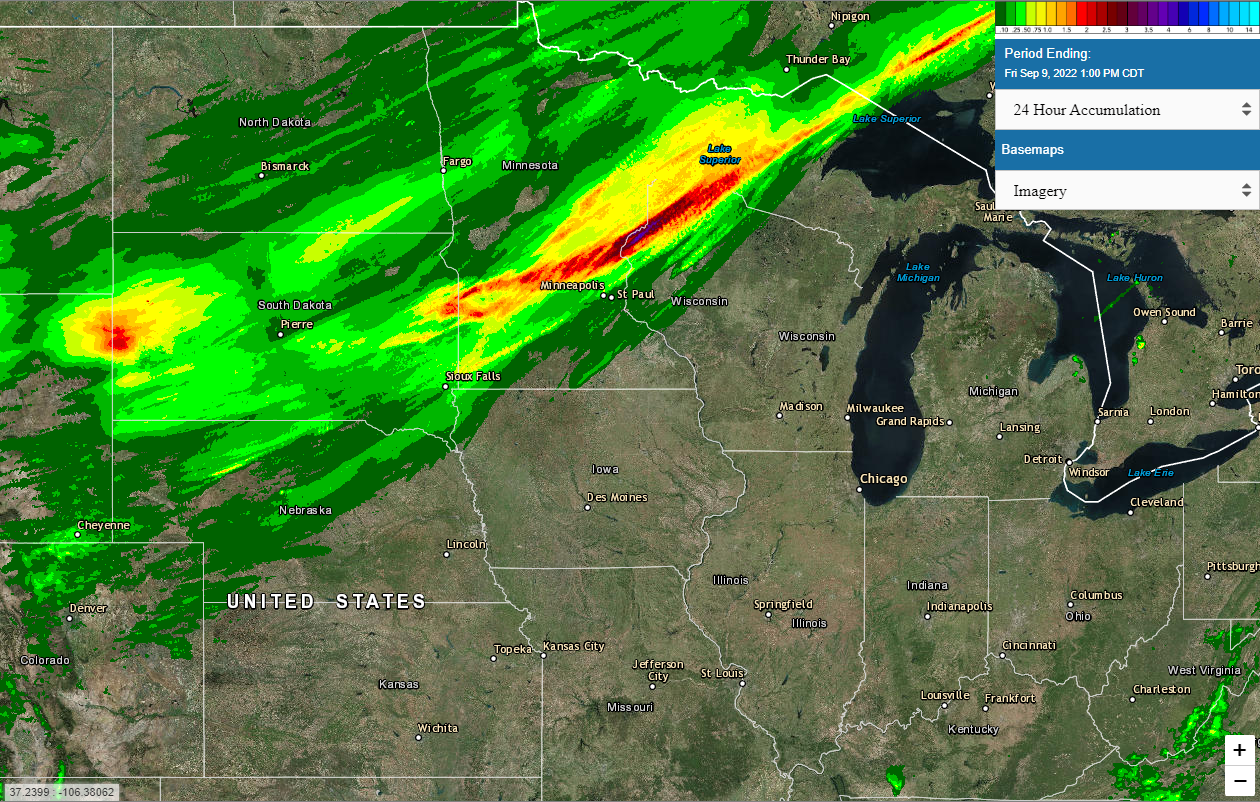

Corn and soybeans were higher from the start of overnight trade and finish Friday with double-digit gains. It appeared that there was not much of a live hand active in trade today and computers were trading between in each other. With corn returning to recent highs in such poor volume, remaining upside now feels very limited following Monday's WASDE report, unless we get some surprise numbers to feed the bull. We have not had a weekly export sales report since the USDA switched to a new report format nearly a month ago. The USDA finally announced today that they would release four weeks of sales data on September 15, split into two separate reports. The USDA confirmed the sale of 104,000 tonnes of soybeans for delivery to Taiwan during the 2022/23 marketing year this morning. There is a lot of buzz surrounding a potential railroad strike. If a shutdown does happen, how much grain will need to be shifted to barge and truck freight? Will we be able to recover from any lost shipping time? We had a nice general rainfall overnight to help push soybeans into the finish. Trade is expecting the USDA to reduce its yield forecast for this year's crop from 51.9 bu/ac to 51.4 b/a in Monday's report.